Borrower relief is necessary in a national emergency, but if the exclusion of the deferred loans from troubled-debt restructurings is extended past the end of the year, safety and soundness could be compromised.

The pandemic has created many great opportunities for finance pros to help their clients.

The COVID-19 pandemic isn’t stopping BDO USA from pursuing a constant series of M&A deals in recent years, although the latest one had to be mostly negotiated at a safe distance.

The COVID-19 pandemic is likely to lead to long-term consequences for organizations, according to a survey of accountants around the world by the Association of Chartered Certified Accountants.

Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

It’s a good time to be opportunistic about your firm’s future — and to poke these embers in a meaningful way.

The Small Business Administration and the Treasury Department unveiled a simpler loan forgiveness application for the Paycheck Protection Program to reflect changes under the PPP Forgiveness Act.

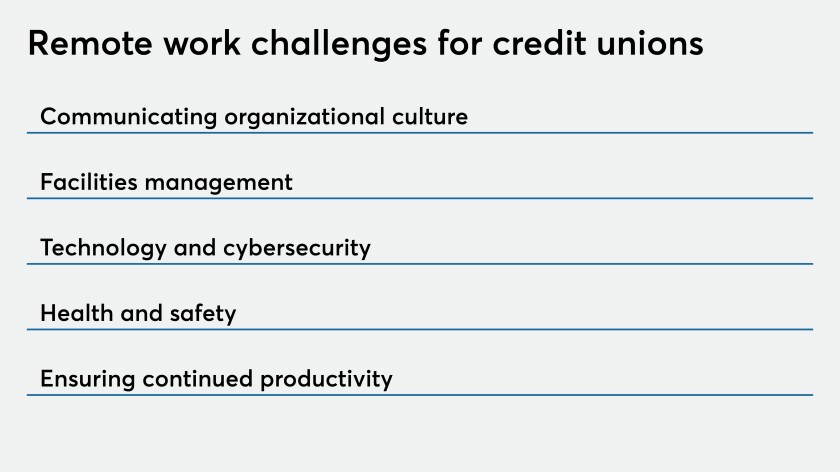

Some of the industry’s biggest institutions intend to keep a significant portion of their staff working from home indefinitely. That’s raising new questions about organizational cultures and how to appropriately utilize credit union facilities.

Gary Boomer, Allan Koltin and Gary Shamis share their top tips to help navigate the pandemic — and the uncertain period beyond it.