Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

Advisors may find it difficult to connect with the people who need financial help the most.

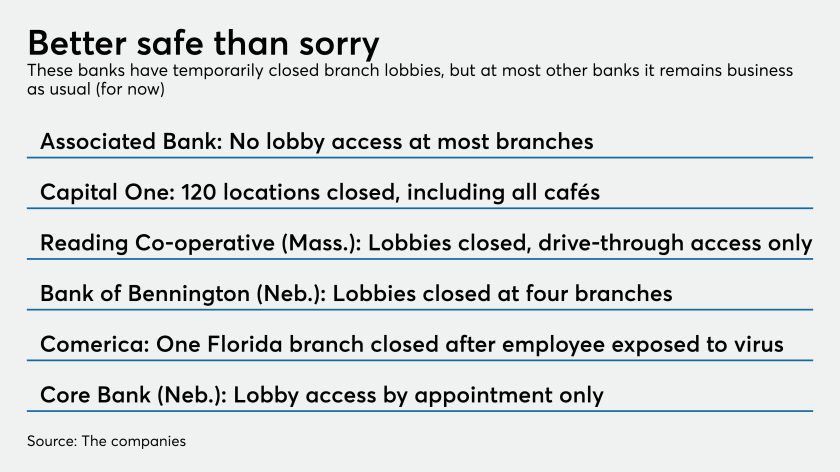

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

The actions include cutting the federal funds rate to between 0% and 0.25% and other steps to ease economic stress from the spread of the coronavirus.

The Conference of State Bank Supervisors on Friday launched a centralized link to state websites highlighting information relevant to business continuity plans for licensed mortgage loan officers.

Many advisors are doing heavy lifting right now — or expect they will be — in the midst of growing coronavirus fears.

More firms are taking stringent measures to protect employees and clients.

There are more than a hundred cases of COVID-19 in Westchester County, New York, and financial planners are handling more than market volatility.

More than six industry events have been cancelled or put on hold in five days, with more likely to follow.

“Find ways to generate income,” says one financial planner.