Accountants and tax professionals have been helping their small business clients deal with the economic fallout from the COVID-19 pandemic, shifting away from their routine compliance work after the end of the prolonged tax season.

Auditors should take stock of the lessons learned from the first phase of remote auditing.

The coronavirus pandemic has introduced a number of new areas that companies need to address.

Disclosures in financial statements and SEC filings about the current and potential impacts of COVID-19 are a major concern.

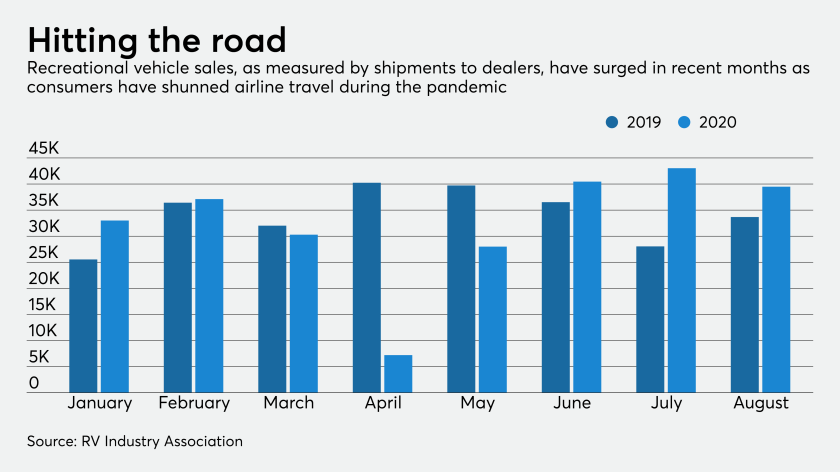

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

Corporate boards of directors are dealing with new problems in financial reporting and accounting.

Here are seven best practices to boost your website’s efficiency and effectiveness.

Despite the many, many downsides of COVID-19, one of the biggest silver linings has been that it forced CPAs and accountants into being true advisors to their clients.

Most companies don’t expect to reduce their office space in the coming year.

There are two key areas that CPA firms should closely watch to manage audit fees in 2020.