The coronavirus pandemic has opened up a number of specific areas with potential for the profession, according to leaders at the AICPA.

Financial firms should offer debt consolidation and faster payment services to help employees who may be struggling through the coronavirus pandemic.

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

The Tax Cuts and Jobs Act created opportunity zones as an economic development tool to stimulate investments in distressed communities.

The COVID-19 pandemic has highlighted the need to have a business continuity and disaster recovery plan and a pandemic plan in place.

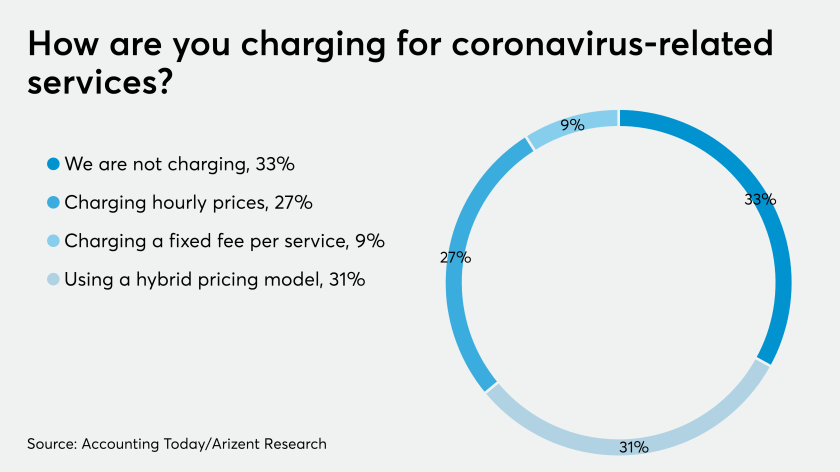

Firms may want to trade short-term cash for long-term goodwill.

Accountants have no need to return to crowded offices, especially not in states where COVID-19 is having a second wind.

The coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

The Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

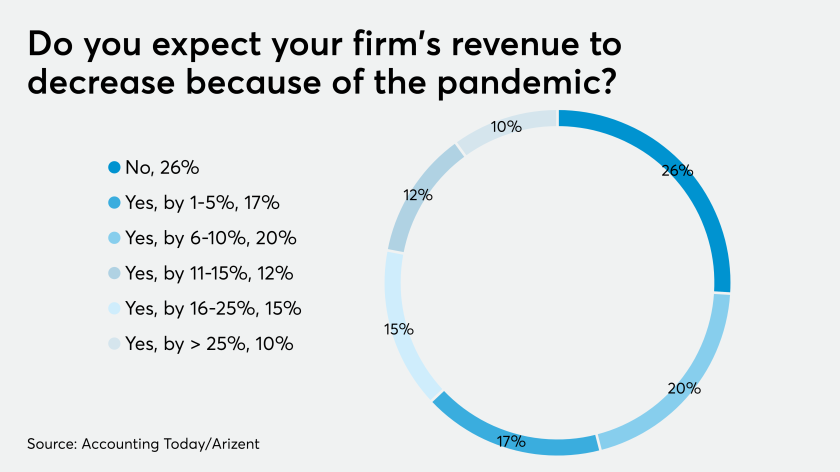

As an accounting professional, these are tough days. But that doesn’t mean your practice can’t grow during this season.