The operators of the venue argue that COVID-19's economic impact makes a $400 million expansion all the more important.

The timing of a $1.5 billion deal California had planned to price Thursday is no longer firm amid massive dislocations in the markets.

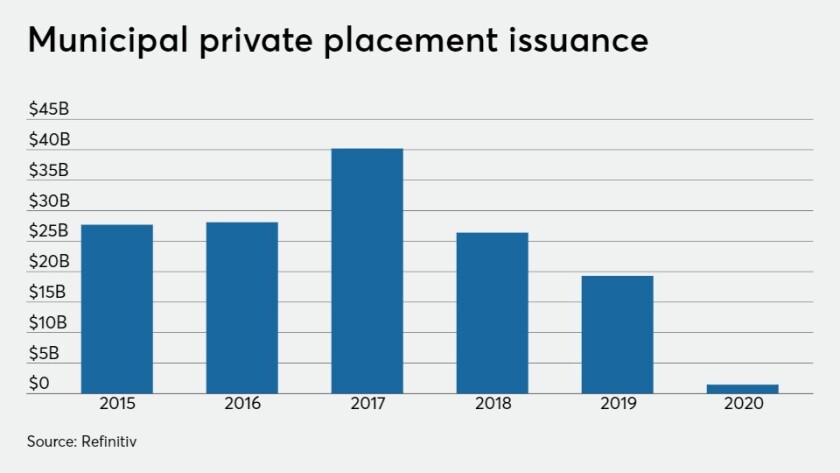

A big New York State Empire Development Corp. private placement is likely to be followed by more until the municipal primary starts functioning again.

Lipper reported a whopping $12.2 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion were from high-yield funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.

Schools in 39 states had closed by Wednesday.

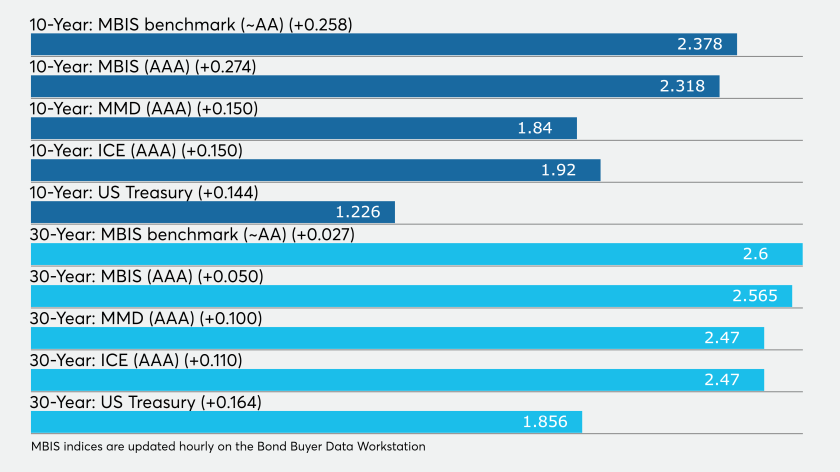

Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

The municipal market is dealing with a major liquidity event, with massive short-end selling.

GLWA has the flexibility to come to market as early as this week, but is monitoring the market in light of the COVID-19 impact.

The municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.

Muni market players may have to rely on more than their basic instincts as the economy heads into stormy weather.