The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

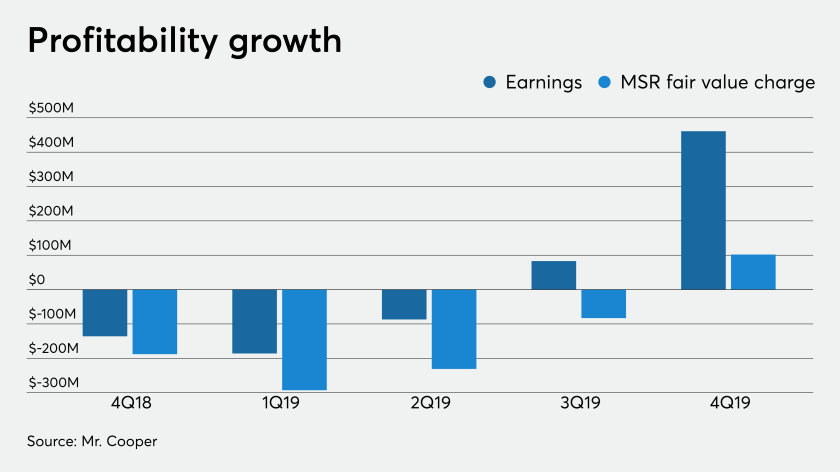

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.