The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

Through its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

Bankers say they’re still trying to figure out if the Fed’s complex loan-buying vehicles will help them cater to the needs of midsize commercial customers hammered by the economic shock from the coronavirus outbreak.

As companies move work off-site because of the pandemic, a host of issues have arisen around remote access, network monitoring and cybersecurity.

The COVID-19 crisis is forcing many banks to hold their spring shareholder meetings online only.

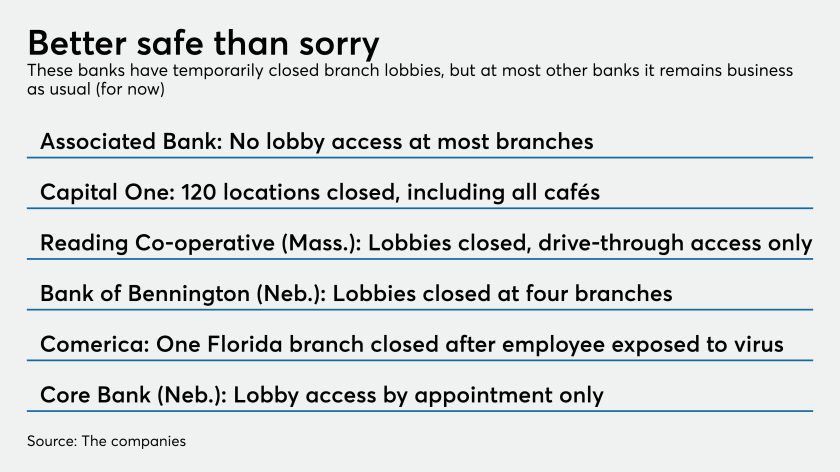

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

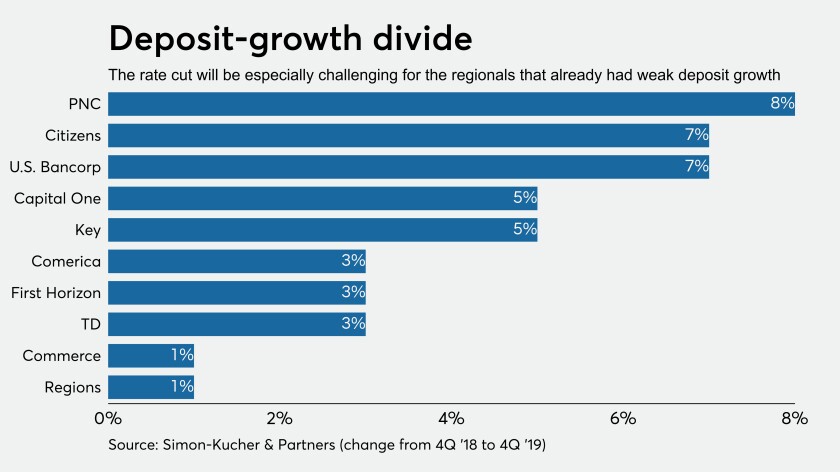

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.