The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

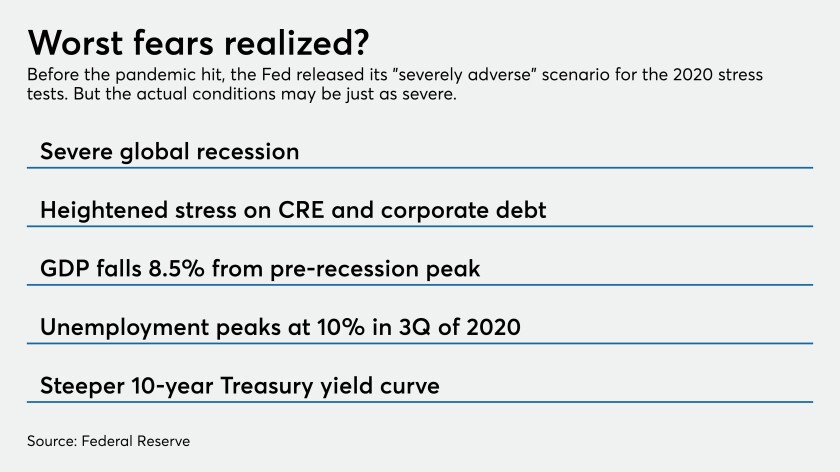

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

Only a firm “actively swindling funds” would trigger an onsite visit, according to Peter Driscoll.

The policy change may prompt more defendants to reach settlements, an attorney says.

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

Regulators issued a rule that gives banks the OK to dip into capital to help households and businesses cope with the economic impact of the coronavirus.

Some attorneys say it's welcome relief, but how long will it take to get new hearing dates?

The OCC and FDIC said banks should consider waiving fees, be flexible with loan repayments and that they would not be penalized if they close branches for precautionary reasons.