Drive-thru is almost synonymous with fast food, but for some quick-serve chains — like Subway — a past emphasis on in-store dining meant a much sharper pivot when the coronavirus pandemic struck.

COVID-19 has accelerated changes in payments behavior that would otherwise have taken years to occur, laying the foundation for global expansion post-pandemic. But for different parts of the world, this digital transformation had very different outcomes.

The humble QR code — invented for automobile manufacturing in 1994 — had been on the rise as a payment method for many years, but the pandemic expanded its use in the U.S. in some unforeseen ways.

Discover is working to help Black-owned businesses and other merchants maintain foot traffic — safely — through the use of the card network's payments technology and its marketing heft.

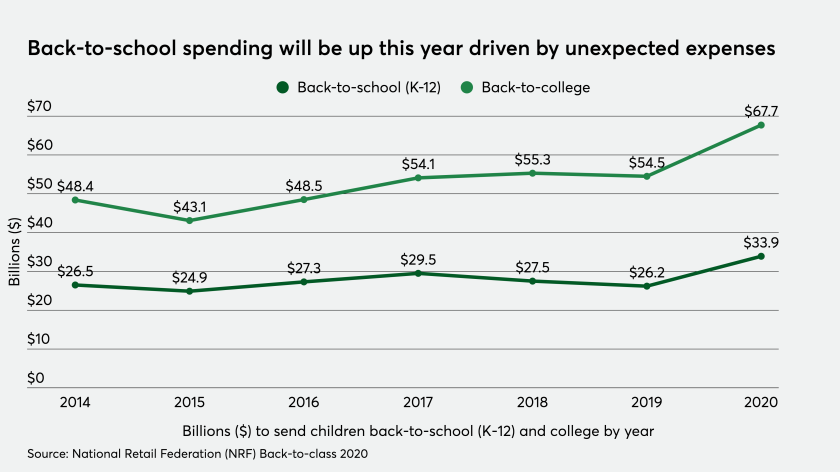

One thing that many parents are finding unusual this year is the amount of money being spent on school supplies during the coronavirus crisis — it’s actually going up.

7-Eleven’s not a quick serve restaurant chain or an e-commerce marketplace, but it still found substantial use for its app as a way to quickly address the health worries of its customers.

Payment processor Elavon purchased Sage Pay four months ago, completing the acquisition on March 11. Two days later, Elavon's entire workforce was operating remotely as the coronavirus forced it into lockdown.

Bill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

Checkout-free stores still feel experimental, but the coronavirus pandemic is pushing more retailers to contemplate how to reduce human interaction in larger settings.

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.