Businesses have turned to workarounds to accommodate the coronavirus’ impact on brick-and-mortar stores, emergency measures that will likely become permanent in order for these businesses to survive into the future.

With more people sheltering at home and grocery stores limiting access, Domino's is seeing a surge in demand for its pizza — and a need to pay delivery drivers their tips and wages after each shift at a time when the credit card orders outpace the cash on hand at each store.

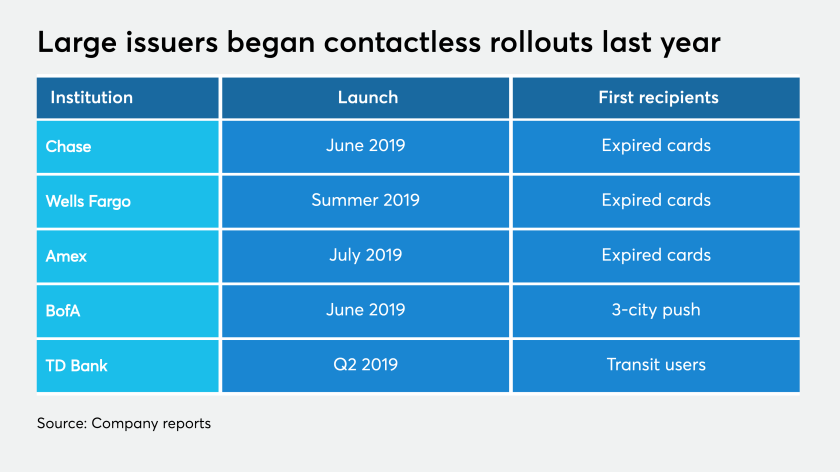

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

One-third of small business owners reported that they don’t expect to survive for more than three months in the current coronavirus-impacted restrictions on shopping, dining and travel.

Interchange fees are a major part of the costs merchants pay to accept payment cards. While merchants seek relief from fees during a time in which their businesses face serious damage from stay-at-home edicts because of coronavirus, the credit card companies and banks quickly began to dig in their heels.

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

U.K. supermarkets which have been experimenting with mobile scan-pay-go may see more consumers adopting the technology due to social distancing requirements in stores.

With coronavirus presenting significant challenges for retailers and the technical challenges of imposing interchange fee changes in the networks, Visa, Mastercard, American Express and Discover are holding off on the updates.

The U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.