Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

The global bank, which has already closed more than 30% of its U.S. branches this year, indicated that the pandemic is prompting it to adjust its plans on the fly.

The prepaid card company benefited from payments that were designed to offset the pandemic’s impact on U.S. consumers.

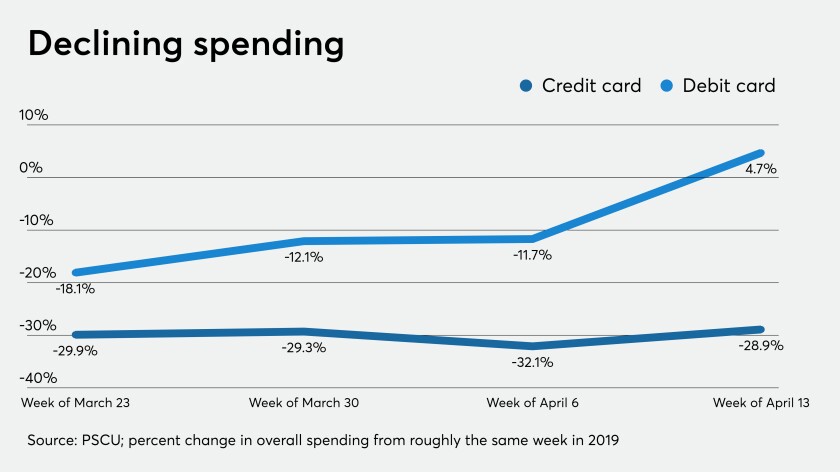

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

Businesses are struggling to adapt to remote work, according to a new survey by Arizent, the parent company of Employee Benefit News.