Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

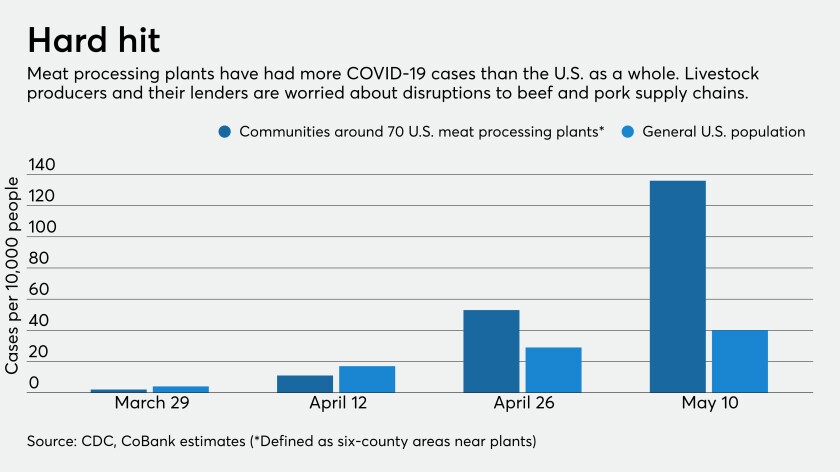

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

But relatively few audit execs are actually performing reviews of critical risk areas such as health and safety.

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

Accountants and finance pros have led in formulating strategy, anticipating risk and determining the best course of action to move forward.

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

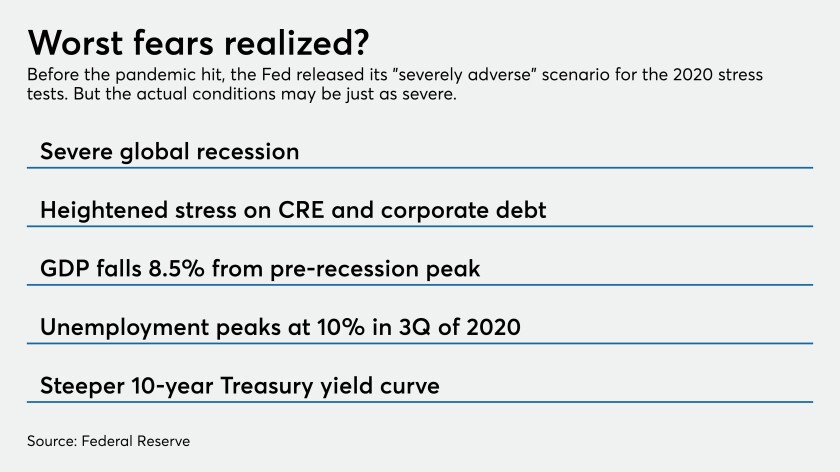

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

Many borrowers will suffer unless the program, the central bank's latest response to the coronavirus pandemic, includes consumer loans issued by fintechs.