Business leaders and accountants should understand three significant SALT issues, if they're expecting an increase of remote employees working in new state or local tax jurisdictions this year.

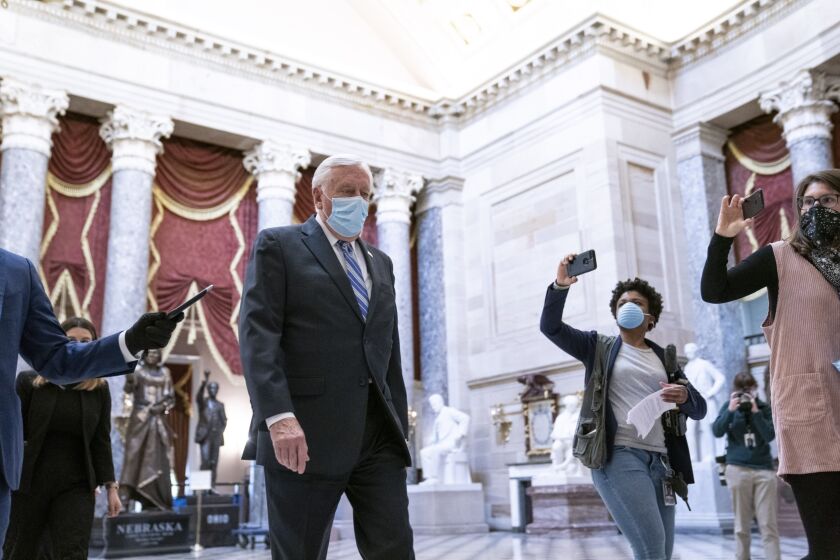

The measure, passed 208-199, would give cash-strapped states and local governments more than $1 trillion while providing most Americans with a new round of $1,200 checks

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Some of the most contested pieces of the 2017 tax overhaul are being revisited as the White House and Congress begin to discuss another round of economic stimulus, including restoring the break for entertaining business clients and lifting the cap on state and local deductions.

One possible move is getting rid of the limit on state and local tax deductions, or SALT, that was part of the 2017 tax overhaul.