Banks would be wise to dust off their Great Recession playbook and shed nonperforming loans while growing through M&A.

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

Most of the disclosures tracked since the beginning of the year were filed in March, the MSRB said.

In the MSRB’s first report showing data from March 24, trades topped 87,215, which is likely a record, said Marcelo Vieira, MSRB director of research.

Canadian policymakers are escalating their efforts to backstop the nation’s financial system and ensure banks have plenty of room to continue lending through the coronavirus crisis.

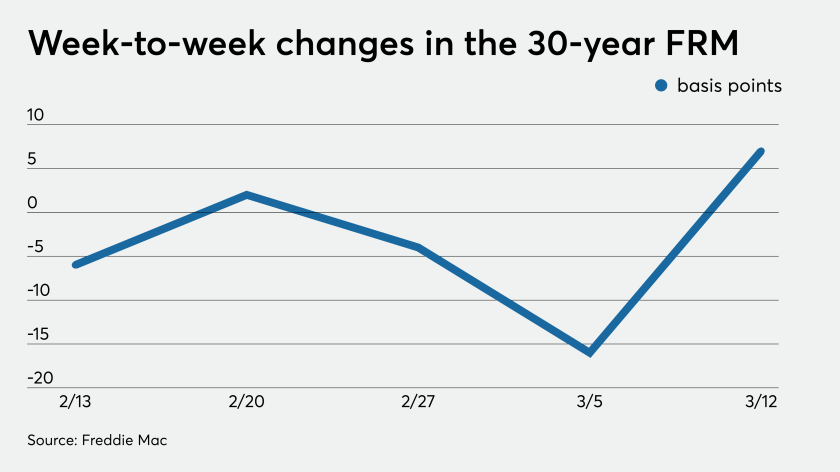

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

Career veterans call fallout from COVID-19 concerns on the municipal market worse than that of 9/11 and the 2008 financial crisis combined.

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.