By incentivizing businesses to rehire employees laid off or furloughed due to COVID-19, states will generate a faster economic recovery and provide valuable assistance for companies to get back on their feet.

The explosion in e-commerce since early March has resulted in a significant increase in online sales tax revenues in most states.

The financial landscape is looking worse than lawmakers expected, sending states to ferret out every opportunity to expand, demand, and open new and broader tax pipelines. No business will be spared.

Do employees working remotely during the pandemic trigger filing obligations for their companies?

From more OICs and higher state taxes, to managing NOLs and the long-term ramifications of the PPP, experts advice predictions for practitioners.

Business operations need cash influxes now more than ever.

The CPA’s first line of defense is to protect e-tailers and brick-and-mortar shops.

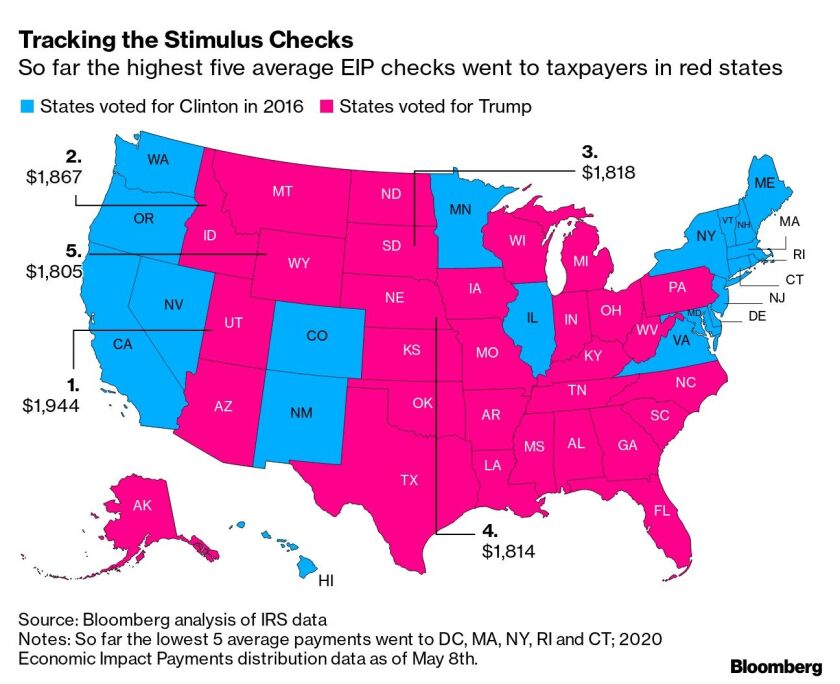

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.

With states and cities facing the worst fiscal crisis in decades, a little-noticed provision in New York’s tax law could put amicable relations with neighboring states to the test.

The coronavirus has caught a number of states off guard, threatening their revenue and impairing their ability to meet obligations that have grown as a result of the epidemic.