Seeing the size and variation in average returns among a variety of asset classes offers perspective for those who are anxious.

Bear markets come with checklists of savvy moves to make for investment portfolios.

An imagined conversation with the legendary Vanguard founder about the coronavirus market crash.

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

“This is a demand and supply shock,” Jay Clayton said, adding that he’s concerned businesses might not have access to all the credit they need.

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

“Find ways to generate income,” says one financial planner.

We can all play a part in preparing for this and future outbreaks.

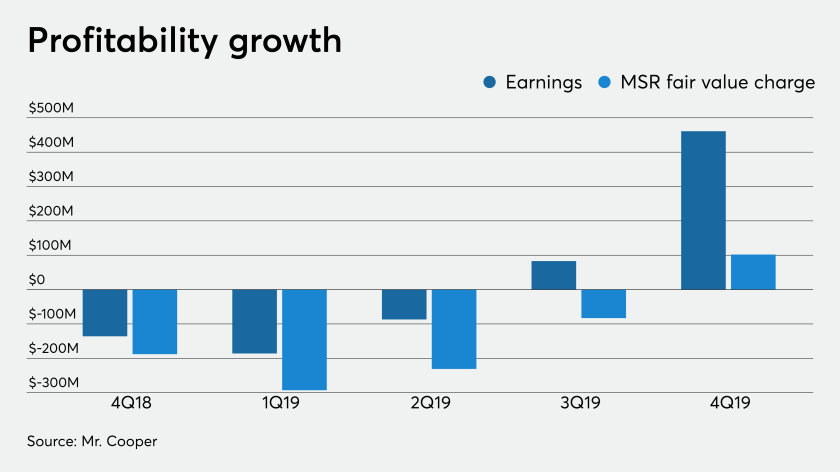

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

Other global health threats, such as SARS, did not have long-term impact on stocks. COVID-19 might be another matter.