Among the pandemic-related issues covered are how to handle the Paycheck Protection Program and other stimulus efforts.

The GOP legislation includes a second tranche of stimulus payments, structured the same way as the earlier round, in March, along with tax credits for businesses.

New regulations to help employers reconcile any advance payments of refundable employment tax credits and recapture the benefit of these credits when necessary, in line with the CARES Act and the Families First Act.

Senate and House Republicans introduced legislation that would give businesses refundable tax credits against payroll taxes to meet some of the expenses associated with reopening during the novel coronavirus pandemic.

The Internal Revenue Service said Wednesday it has begun to send letters to taxpayers who are seeing delays in the processing of their Form 7200, Advance Payment of Employer Credits Due to COVID-19.

By incentivizing businesses to rehire employees laid off or furloughed due to COVID-19, states will generate a faster economic recovery and provide valuable assistance for companies to get back on their feet.

The Internal Revenue Service is extending timelines for performing some of the actions associated with the low-income housing tax credit and bonds for qualified residential rental projects to give businesses more time during the COVID-19 pandemic.

The IRS and the Treasury gave tax relief to businesses and investors who were engaged in New Markets Tax Credit transactions but couldn’t get them done in time due to the COVID-19 pandemic.

In response to the coronavirus, the Internal Revenue Service and the Treasury are giving renewable energy companies more time to develop projects using sources such as wind and geothermal.

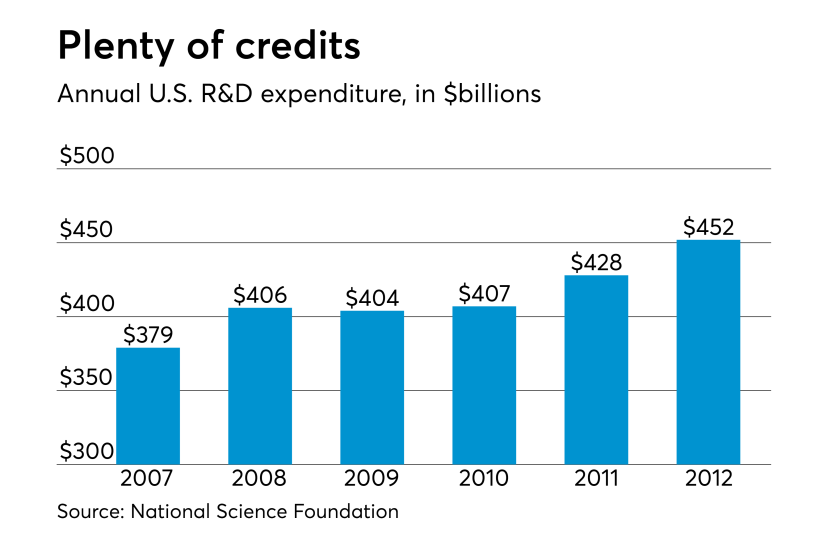

Research credits could look very different for some companies in 2020 compared to other years.