With the filing season upon us, a raft of brand new challenges await ahead of the April 15 deadline.

With only a few days to go before the end of a difficult year, some accountants and tax professionals are still hoping to finish up some perplexing issues for their clients before New Year’s Day.

The coronavirus slowdown has hit the IRS and tax professionals,

The pandemic is 'turning up the volume' on security risks, according to security experts.

As if tax season isn’t already stressful enough, the coronavirus pandemic is making things that much harder.

We just got through a most unusual “tax season,” with taxes pushed aside at the beginning of April to be consumed with the SBA and PPP.

The guys in the brown uniforms became United Problem Solvers; why are you still pushing tax returns?

Keeping in touch with clients is very important, especially during this period of isolation. Here is a way to provide updates to clients regarding their tax returns and to keep in touch generally.

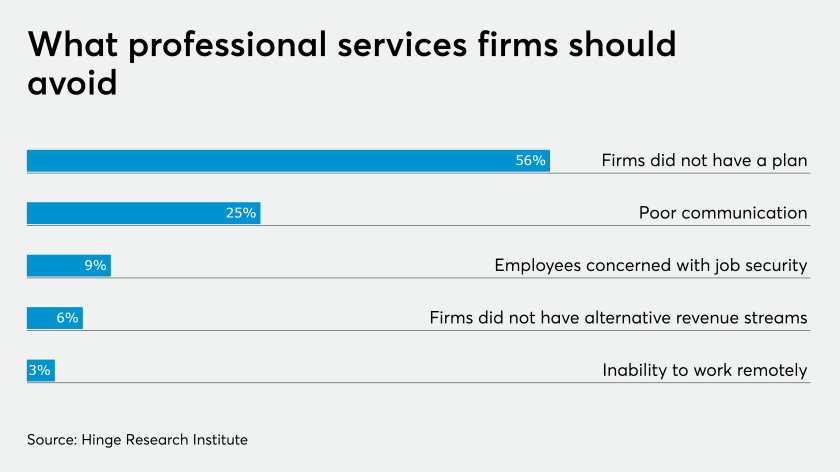

Here are 10 suggestions to help firms think through near-term needs and create a plan to help shore up business continuity and mitigate some risks during this sensitive time.

We are on new ground with the coronavirus pandemic, and we need to adapt as much and as quickly as possible.