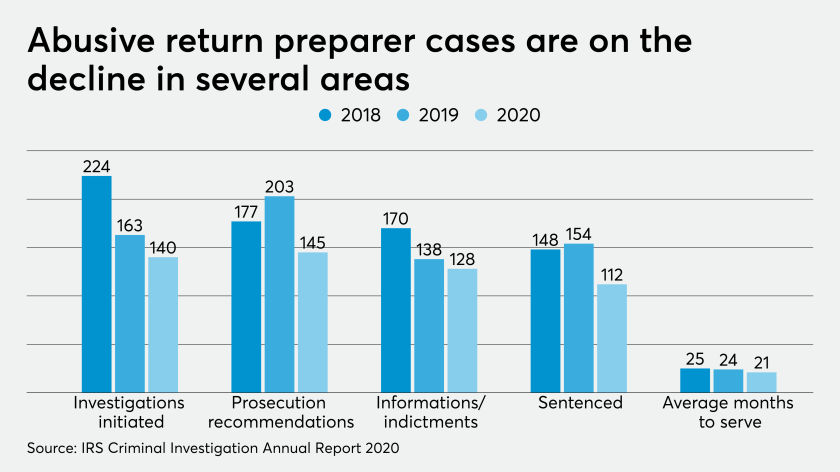

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

The coronavirus slowdown has hit the IRS and tax professionals,

Starting in May, preparation will be free for police, firefighters, EMTs and health care workers.

Pandemic or not, taxpayers are making many of the same blunders, according to tax professionals.

The Treasury Department is pushing back the tax payment due dates for wine, beer, distilled spirits, tobacco products, firearms and ammunition excise taxes to offer them more flexibility for businesses that have been negatively affected by the coronavirus pandemic.

The Internal Revenue Service is shutting down its Practitioner Priority Service line, e-Services Help Desk, as well as the e-Services FIRE and AIR system help desks, until further notice, due to staff limitations amid the pandemic.

Telework eligibility; ineffectual and evil; unpredictable refunds; and other highlights from our favorite tax bloggers.

With new technology, new workflows, and plenty of hand sanitizer, preparers are ready for the disease.