A bipartisan group of lawmakers has introduced legislation to close a loophole in the CARES Act.

The Internal Revenue Service and the Treasury Department are beginning to send nearly 4 million economic impact payments by prepaid debit card, instead of by paper check or direct deposit.

The Internal Revenue Service is bringing in more help to deal with the flood of calls about economic impact payments.

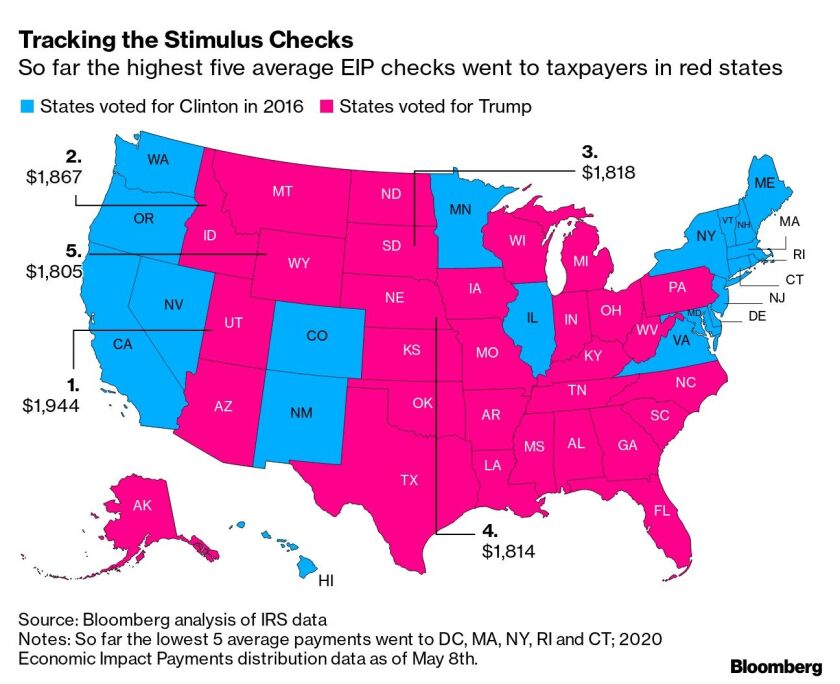

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.

The Internal Revenue Service is giving taxpayers who want to receive their economic impact payments by direct deposit a tight deadline.

The Internal Revenue Service said individuals who got a $1,200 stimulus payment intended for someone who’s deceased or incarcerated should return the money but left open the question of how the agency would enforce that.

The Internal Revenue Service has posted information on how people who weren’t supposed to receive their economic impact payments for the novel coronavirus pandemic should return the money.

The U.S. Treasury Department is planning to instruct people whose deceased relatives received coronavirus stimulus payments to return the money to the federal government, according to a department spokesman.

The Internal Revenue Service posted a set of questions and answers Monday to help companies claim net operating losses and tax credits for prior years so they can get faster tax refunds in the midst of the novel coronavirus pandemic.

The novel coronavirus pandemic has forced the Internal Revenue Service to dramatically scale back operations late in tax-filing season, according to a new report.