Small business owners who got Paycheck Protection Program loans could qualify for big write-offs from their rescue money, amounting to what Treasury Secretary Steven Mnuchin has called a tax-break “double dip.”

The House and Senate are set to vote Monday on $900 billion in pandemic relief aimed at boosting the U.S. economy into the early spring, combined with $1.4 trillion to fund regular government operations for the rest of the fiscal year.

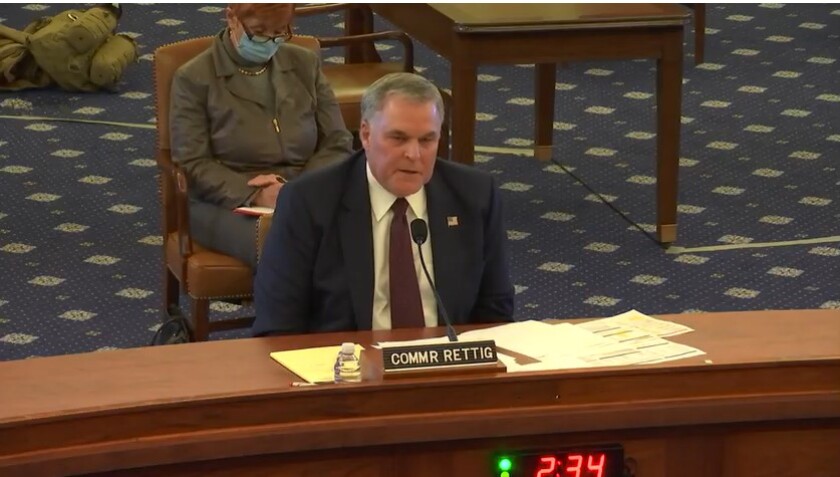

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

The Internal Revenue Service reminded taxpayers Thursday that they only have until Nov. 21 at 3 p.m. Eastern Time to register for an Economic Impact Payment of $1,200 or more.

The IRS is making some changes in its collection program to lessen the burden on taxpayers with outstanding tax debts who are trying to cope with the economic fallout of the COVID-19 pandemic.

The Internal Revenue Service is giving taxpayers more time until Nov. 21 to register their dependents for the $500 per child Economic Impact Payments provided under the CARES Act.

The AICPA believes taxpayers will be able to avoid penalties if they write “COVID-19” at the top of their return.

The Internal Revenue Service is giving taxpayers a break if the checks they mailed in to pay their taxes still haven’t been opened up yet and are sitting in the trailers the IRS set up during the pandemic.

The Internal Revenue Service is giving parents another chance to list their kids so they can receive an extra $500 per child in economic impact payments under the CARES Act.

President Donald Trump announced four executive actions on Saturday, including continued expanded unemployment benefits and a temporary payroll tax deferral for some workers, as the coronavirus pandemic continues to hobble the U.S. economy.