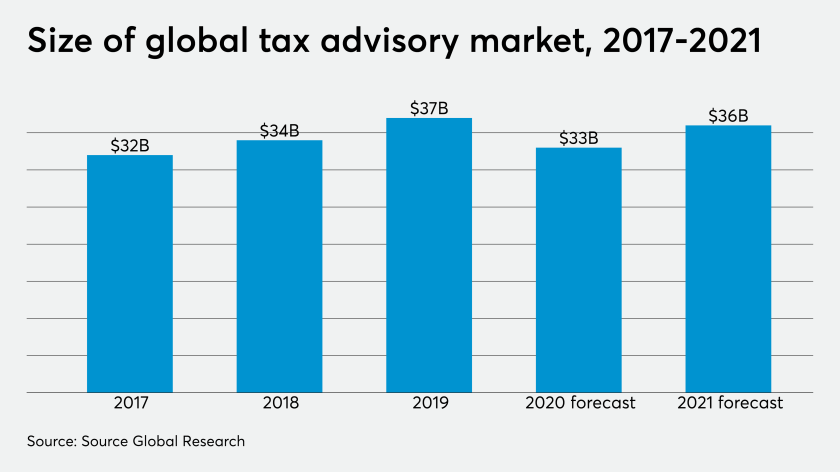

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

Revenue dropped 6 percent as the pandemic triggered economic shutdowns across the country, according to data from 44 states compiled by the Urban Institute.

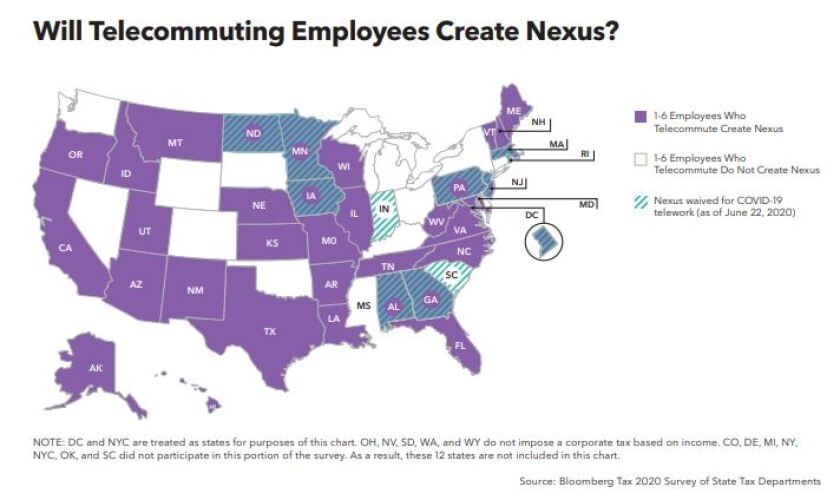

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.

If you have an income of $1 million or more there’s less than a 1% chance that the IRS has called you in for an audit, according to new figures from the agency.

The new format aims to showcase the IRS’s work in fiscal year 2019, along with an additional message about its response this year to the novel coronavirus pandemic.

The CPA’s first line of defense is to protect e-tailers and brick-and-mortar shops.

One strategy being used across international regions is to utilize value-added tax measures as a flexible and effective response to the economic slowdown.