With vast numbers working outside the office, practitioners are advising care.

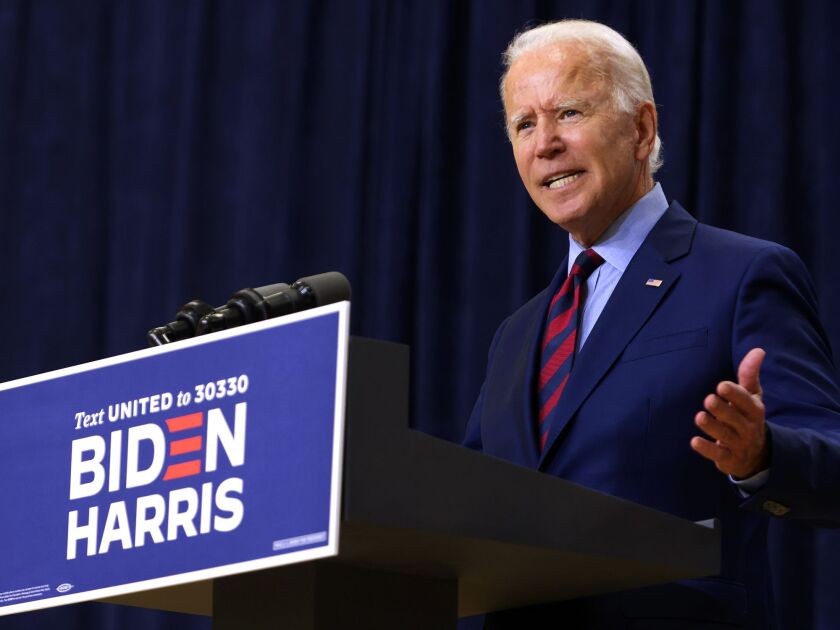

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

The AICPA believes taxpayers will be able to avoid penalties if they write “COVID-19” at the top of their return.

The Internal Revenue Service is giving taxpayers a break if the checks they mailed in to pay their taxes still haven’t been opened up yet and are sitting in the trailers the IRS set up during the pandemic.

Even the extra time to file hasn’t been enough for some businesses struggling to pay the government as the pandemic threatens to worsen.

The tax deadline is coming Wednesday after tax season was extended by three months to give taxpayers and preparers more time to deal with the novel coronavirus pandemic, but many of them will be dealing with extensions and amended returns in the months ahead.

The Internal Revenue Service won’t further delay the tax filing and payment deadline past July 15, despite requests to do so, the agency said Monday.

The extension also applies to Americans living abroad who would otherwise generally have had a filing deadline of June 15.

The U.S. Treasury Department is planning to instruct people whose deceased relatives received coronavirus stimulus payments to return the money to the federal government, according to a department spokesman.

Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.