Nonprofits, lawmakers and others want to see more giving from fund donor-advised funds, which have grown popular recently because they’re so flexible.

The act increased many of the limits from the Tax Cuts and Jobs Act, and the IRS has offered more guidance.

From more OICs and higher state taxes, to managing NOLs and the long-term ramifications of the PPP, experts advice predictions for practitioners.

Pandemic-induced market volatility and warnings from Wall Street that tax rates are bound to rise have more Americans preparing to move money from traditional individual retirement accounts into Roth IRAs.

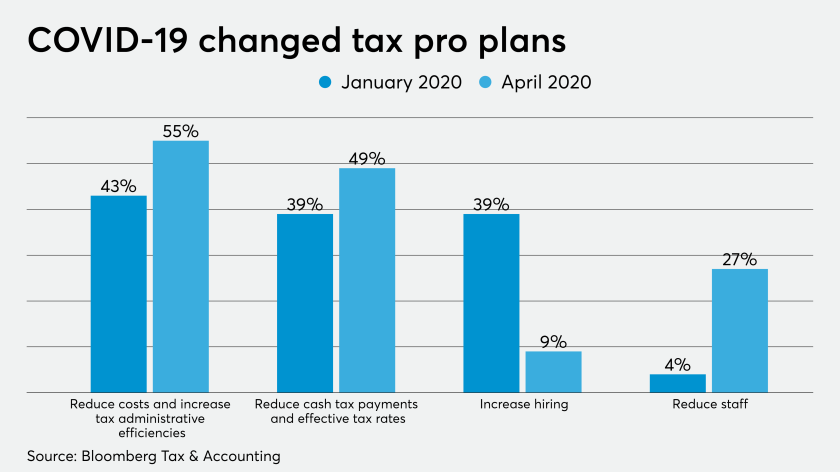

The COVID-19 pandemic is forcing corporate tax departments to reconsider their top priorities for this year, according to a new survey.

Lax eligibility requirements are raising new questions about which firms should get access to public money.

Divorce and COVID-19 each bring various tax considerations.

There's a great deal of help for businesses in the CARES Act and the FFCRA.

Rich Americans are taking advantage of an unprecedented opportunity, made possible by the coronavirus pandemic, to transfer money to their children and grandchildren tax-free.

Just before the coronavirus roiled the economy, wealthy investors piled into funds that take advantage of a popular, two-year-old tax break meant to help poor communities.