President Donald Trump announced four executive actions on Saturday, including continued expanded unemployment benefits and a temporary payroll tax deferral for some workers, as the coronavirus pandemic continues to hobble the U.S. economy.

Democrats are demanding more Republican concessions to meet an end-of-the-week deadline for a deal on pandemic relief, and one of the chief White House negotiators warned there is little time left for negotiations.

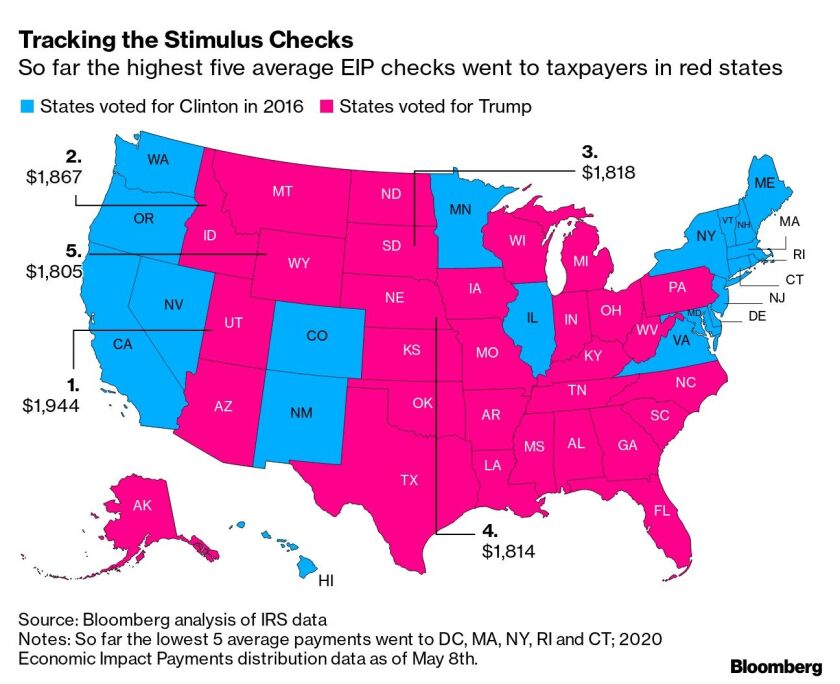

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.

The new federal COVID-19 relief package probably won’t be the last boost the U.S. economy will get, economists say.

The Trump administration’s $349 billion small-business rescue kicked off Friday surrounded by concerns about its ability to handle an expected flood of applications and deliver enough aid to mom-and-pop firms hit hardest by the coronavirus pandemic.

One possible move is getting rid of the limit on state and local tax deductions, or SALT, that was part of the 2017 tax overhaul.

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

New York Gov. Andrew Cuomo promised a 90-day moratorium on mortgage payments for financially strapped New Yorkers because of the coronavirus.

The temporary foreclosure moratorium on loans backed by HUD, Fannie Mae and Freddie Mac comes after lawmakers and housing advocates had pushed for steps to avoid consumers getting booted from their homes.

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.