Most of the Top 100 CPA firms reportedly are showing significant increases in revenue in their SUT practices.

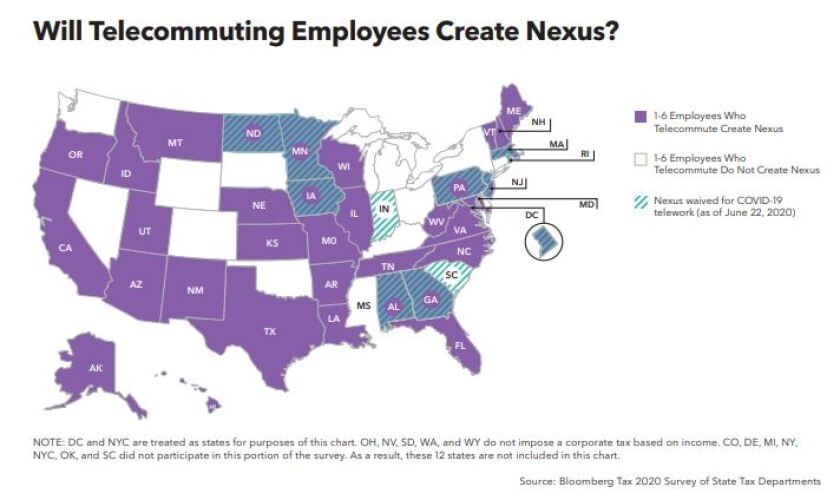

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.

The explosion in e-commerce since early March has resulted in a significant increase in online sales tax revenues in most states.

The financial landscape is looking worse than lawmakers expected, sending states to ferret out every opportunity to expand, demand, and open new and broader tax pipelines. No business will be spared.

The coronavirus has caught a number of states off guard, threatening their revenue and impairing their ability to meet obligations that have grown as a result of the epidemic.