During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

The Internal Revenue Service is giving taxpayers a break if the checks they mailed in to pay their taxes still haven’t been opened up yet and are sitting in the trailers the IRS set up during the pandemic.

U.S. Senator Bernie Sanders said he will introduce legislation to tax what he called the “obscene wealth gains” from billionaires during the coronavirus crisis.

The American Institute of CPAs reported Thursday that its Personal Financial Satisfaction Index declined 55 percent in the second quarter of the year, a level not seen since 2015, as the COVID-19 pandemic continued to ravage consumer finances.

The Tax Cuts and Jobs Act created opportunity zones as an economic development tool to stimulate investments in distressed communities.

Dozens of millionaires from the U.S. and six other countries have a message for their governments: “Tax us. Tax us. Tax us.”

The Senate and House passed bipartisan legislation to help nonprofits remain financially viable during the COVID-19 pandemic.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

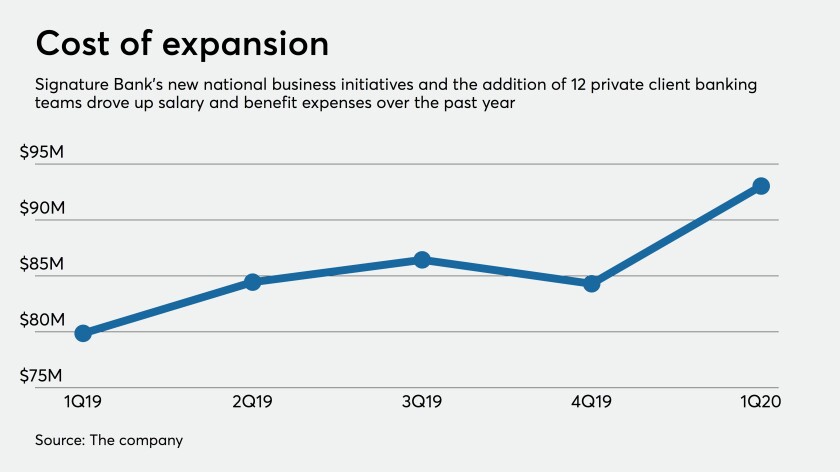

The New York commercial bank says geographic diversification is a long-term necessity and that the interplay of its private banking and commercial banking businesses has helped it withstand the economic shock of the coronavirus.

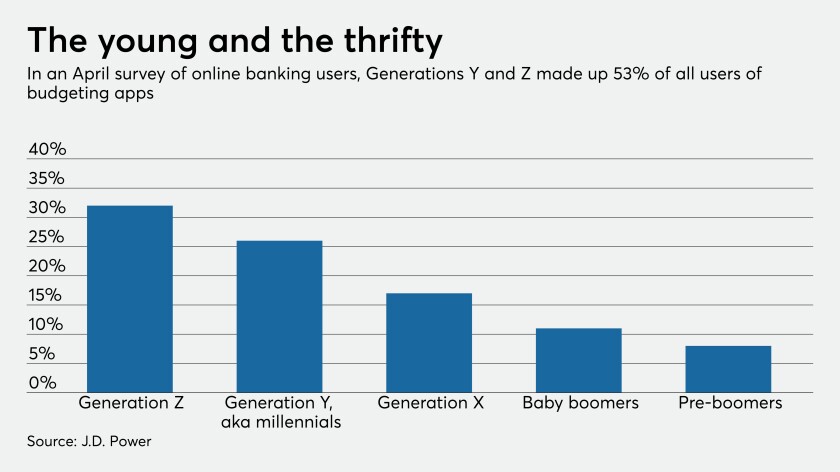

With money flow suddenly stifled for millions of customers, demand for money management tools has skyrocketed.