Financial advisors, broker-dealers, custodians and other firms are trying to do their part amid a public health and economic crisis.

Now is not the time to disconnect from supportive networks of other advisors.

My training in virology, laboratory pathology and emergency medicine gives me a different perspective of how to manage our society’s new path forward, writes M.D. and planner Carolyn McClanahan.

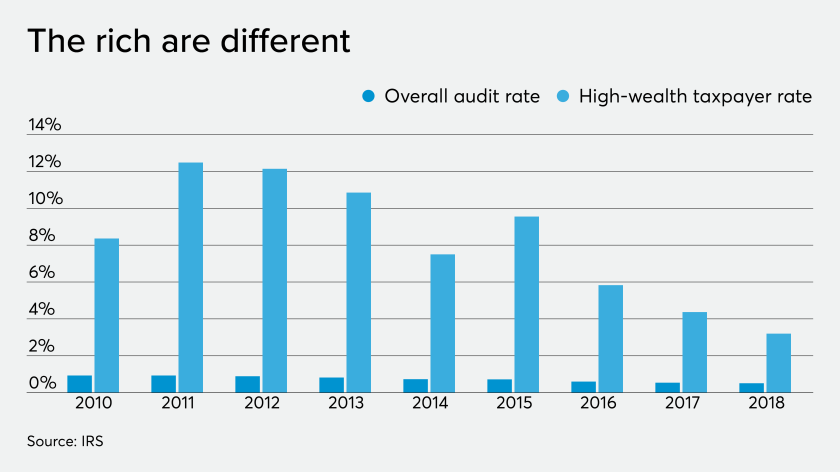

Rich Americans are taking advantage of an unprecedented opportunity, made possible by the coronavirus pandemic, to transfer money to their children and grandchildren tax-free.

As soon as the program was announced, I not only advised my small business clients to apply; I also tried to figure out how to take advantage of it myself.

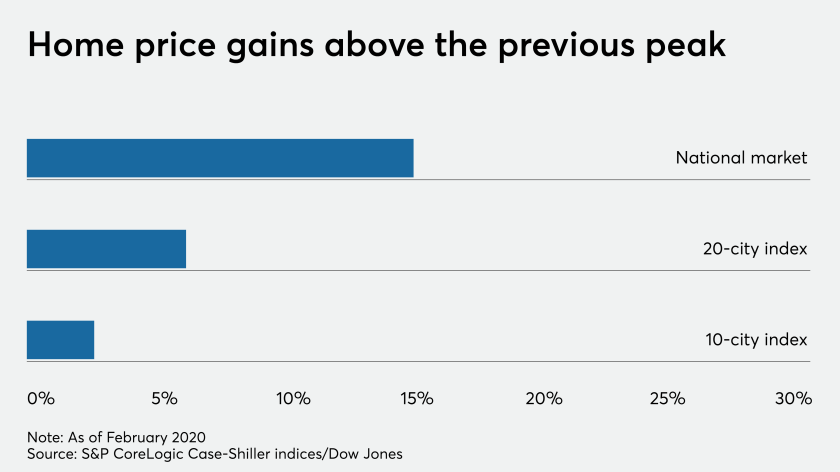

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

Just before the coronavirus roiled the economy, wealthy investors piled into funds that take advantage of a popular, two-year-old tax break meant to help poor communities.

I am advising some clients to ladder maturities to lock in more dependable tax-free income streams — especially for those in states with high income taxes, like California.

Under the new act, some can take out as much as $100,000 from retirement plans early without penalty.

The novel coronavirus pandemic is causing the biggest drop in Americans’ financial situation in over a decade.