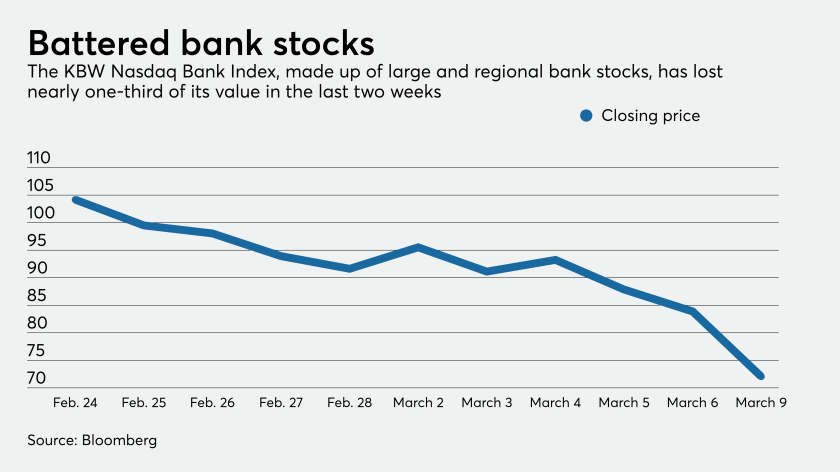

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

Advisors may find it difficult to connect with the people who need financial help the most.

Many advisors are doing heavy lifting right now — or expect they will be — in the midst of growing coronavirus fears.

Sen. Sherrod Brown of Ohio, the top Democrat on the Banking Committee, said financial institutions "need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

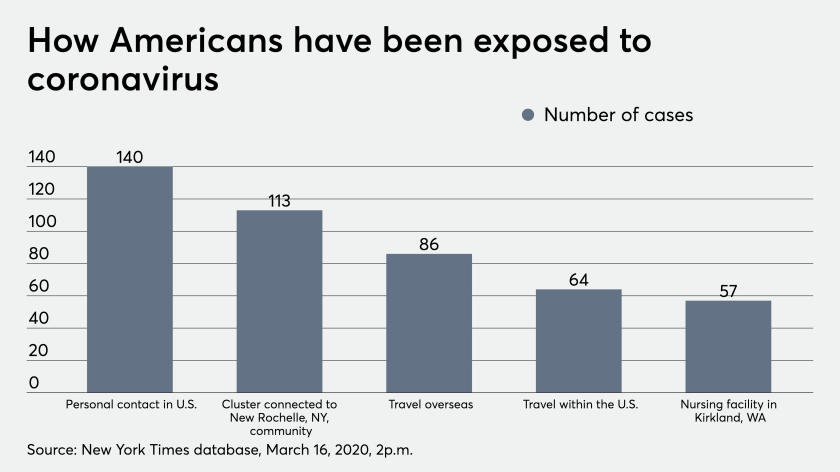

There are more than a hundred cases of COVID-19 in Westchester County, New York, and financial planners are handling more than market volatility.

Where some see unacceptable risk, others are eyeing bargain airplane tickets.

The early U.S. epicenter of the virus hasn’t seen mass closures of practices, but financial advisors from the area shared tips to try to get ahead of the impact.

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

There is quite a bit of data indicating planners timed the markets poorly during the financial crisis. Let's not make the same mistakes again.

The richer they are, the more options clients have to insulate themselves from the coronavirus and its effects.