We are not back to normal, and WFH is not a perk … yet.

Accountants have no need to return to crowded offices, especially not in states where COVID-19 is having a second wind.

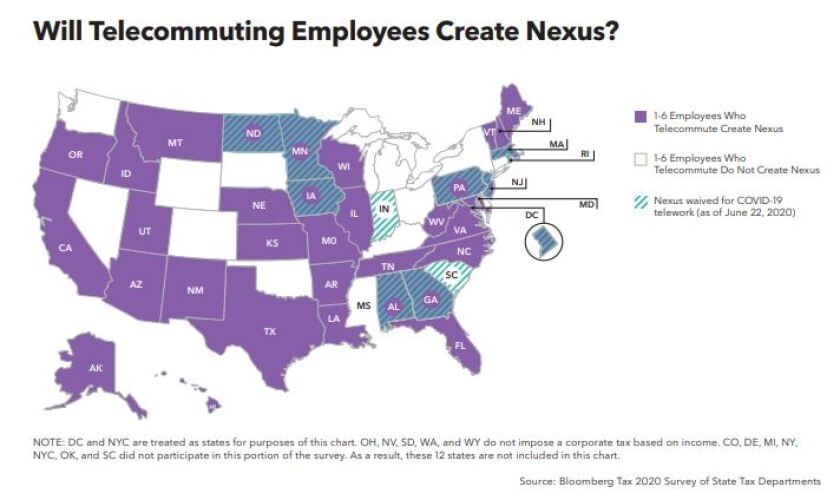

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.

2020 is testing the profession’s resiliency like nothing has before, and accountants are losing sleep, skipping vacations, and working longer hours to adapt to the challenges COVID-19 has brought.

Deloitte is helping its corporate clients get ready to prepare their quarterly financial statements in the midst of the novel coronavirus pandemic, as its own employees grow more accustomed to doing remote audits while working from home.

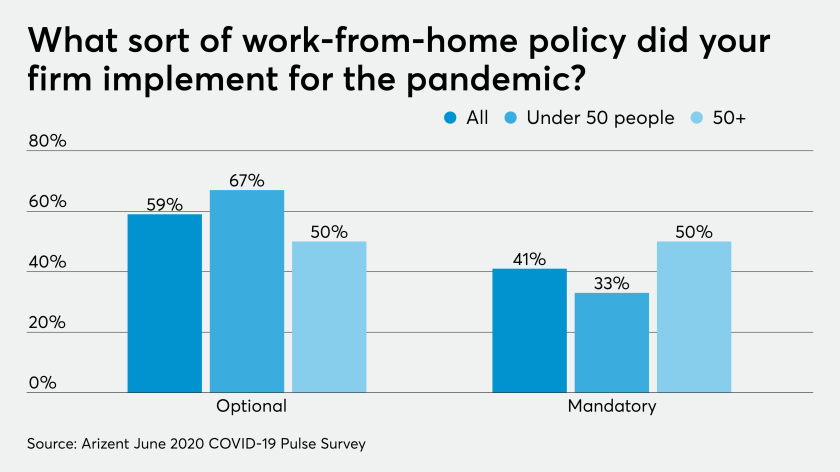

A new study also found that accountants are, by and large, very pleased with how their firms have responded to the pandemic.

The 2017 tax law eliminated the federal write-offs previously allowed for unreimbursed business expenses and home offices, along with most other miscellaneous itemized deductions.

Accounting’s thought leaders predict how the profession can expect to successfully emerge from the crisis.

Long-term changes are brewing underneath the surface issues surrounding the current crises.

Some of the industry’s biggest institutions intend to keep a significant portion of their staff working from home indefinitely. That’s raising new questions about organizational cultures and how to appropriately utilize credit union facilities.