Jo Jagadish, who joined TD Bank in April as head of commercial products and payments innovation, spent her childhood moving from country to country, so she's used to a world without borders — the kind of world emerging from the capabilities of fintech and demands of the pandemic.

Brick-and-mortar merchants that have shifted to online have changed their risk profile, causing conflicts with the fintechs like Square that handle their payments. And that could be an opportunity for banks.

The bank says fraud attempts involving commercial wire transfers have escalated since the outbreak began. It's training employees and customers how to head off the often hard-to-detect scams.

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

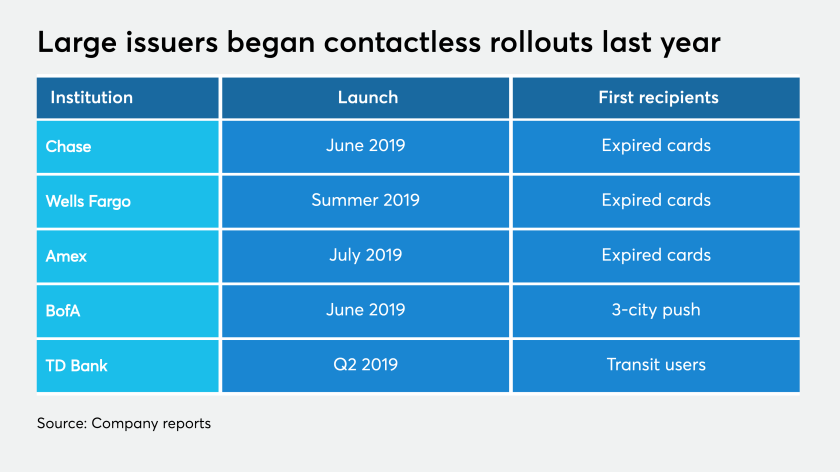

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.