The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

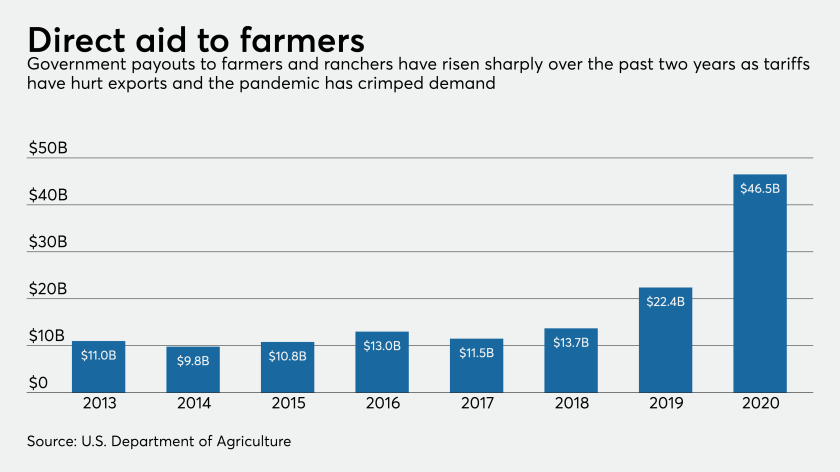

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

The company's Silicon Valley Bank unit reduced its loan-loss cushion by $52 million. Private-equity and VC clients have warmed to the practice of doing deals virtually, which increases lending opportunities, SVB executives said.

Many of the Buffalo, N.Y., bank’s commercial loans have exited forbearance granted in the early days of the pandemic — except hospitality and retail, which were given longer dispensation.

The coronavirus pandemic has spurred more private buyers to acquire senior care homes, and the Oklahoma lender is eager to back them.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.