Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

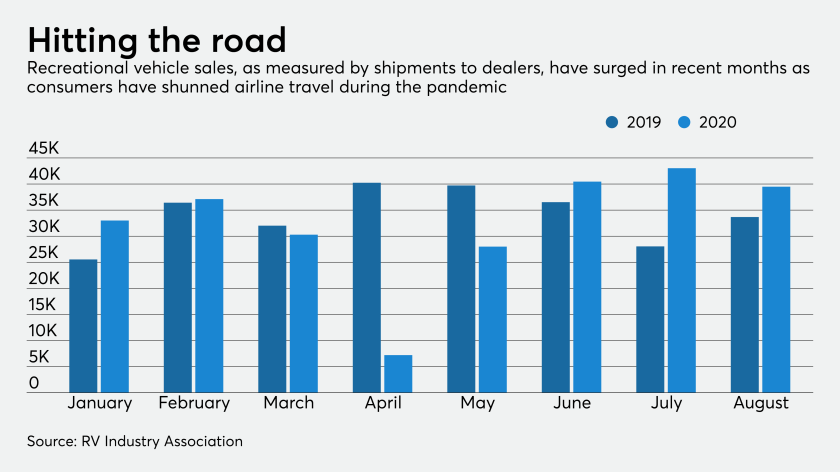

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.

The performance of about $3 billion in hotel and other loans flagged by the Dallas company as high-risk has been a "a pleasant surprise," its chief credit officer said at an industry conference.

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

Just eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

The owner of The Shuckery in Petaluma, Calif., says she was unable to get a Paycheck Protection Program loan until she responded to an email from the delivery service and BlueVine.

This personal funding has blurred the line between personal and business finances more than ever.

Current economic conditions will have "a continued adverse effect on our businesses” if they persist or worsen, Bank of America warns.