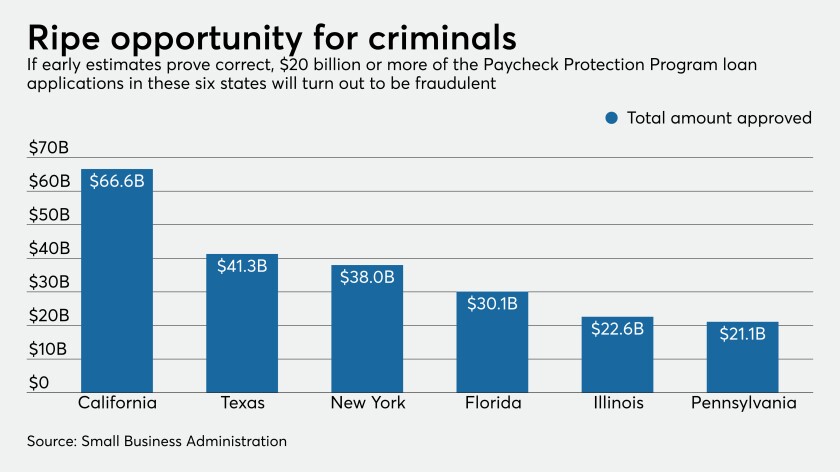

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

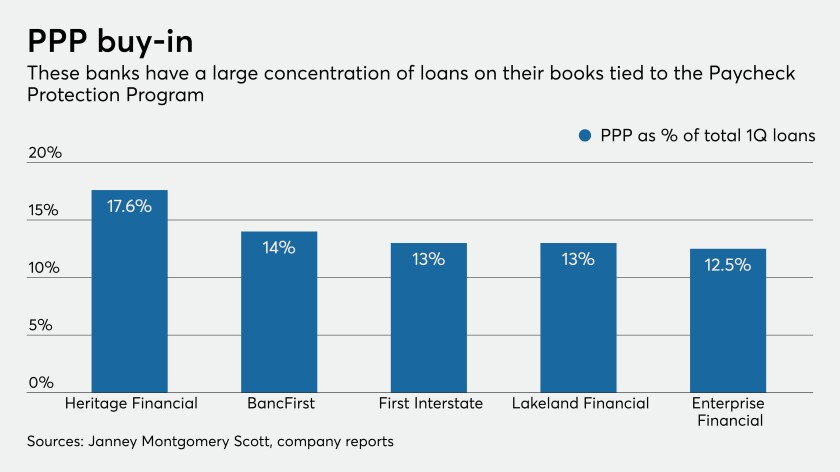

Regulators need to give more detailed guidance on the coronavirus relief program for small businesses so lenders don’t get trapped in underwriting mistakes down the road.

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

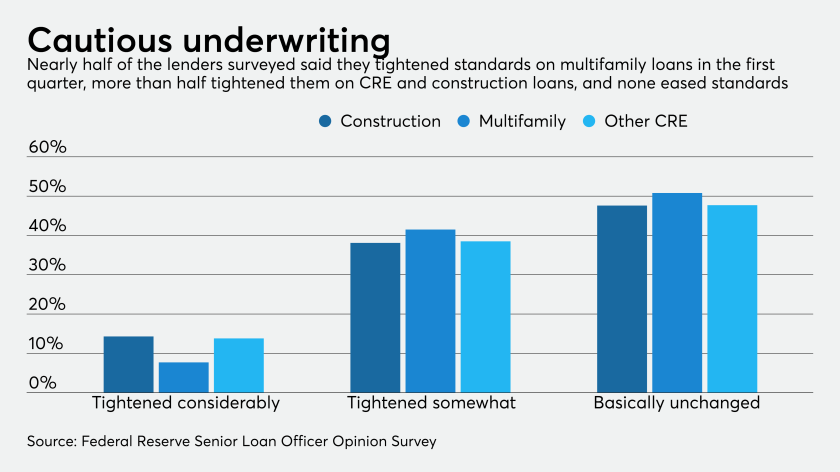

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

The Fed has tweaked its Main Street Lending Program to stir more enthusiasm, including the creation of a third financing option for larger companies. Will it make a difference?

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

The Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

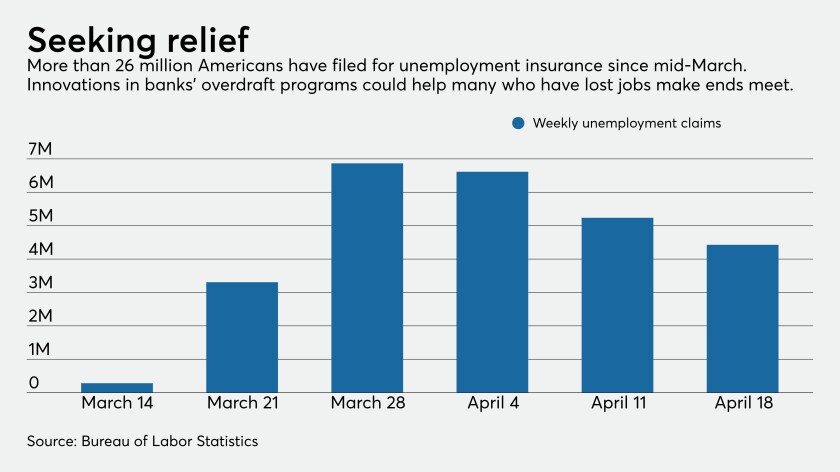

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.