An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

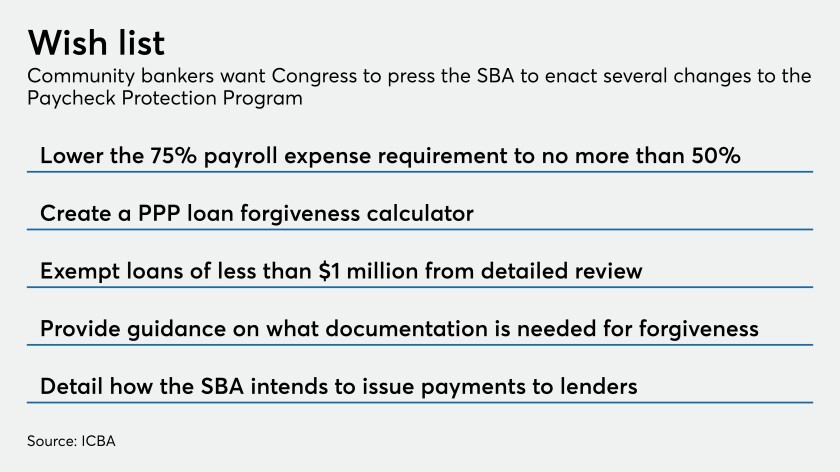

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

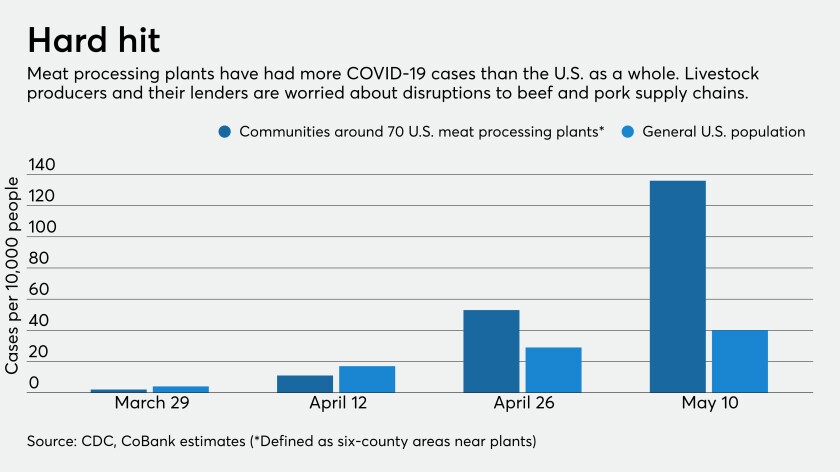

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

A properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.