- 2 Min Read

The ATM industry was already mired in the painful transition away from hardware to digital technology, and now it must try to persuade consumers and merchants that cash isn’t unsafe to handle.

6 Min ReadAfter initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

4 Min ReadJames Smith, who recently completed his gradual transition out of banking, was spearheading a public-private economic development plan for Connecticut when the coronavirus pandemic hit. The crisis made the need for the plan greater — and the job harder.

3 Min ReadDigital banking has ramped up during the coronavirus lockdown but customers will seek somewhere to go as cities reopen. A branch could provide that safe haven.

2 Min ReadEven after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

5 Min ReadForecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

5 Min ReadDemand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

5 Min ReadCustomers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

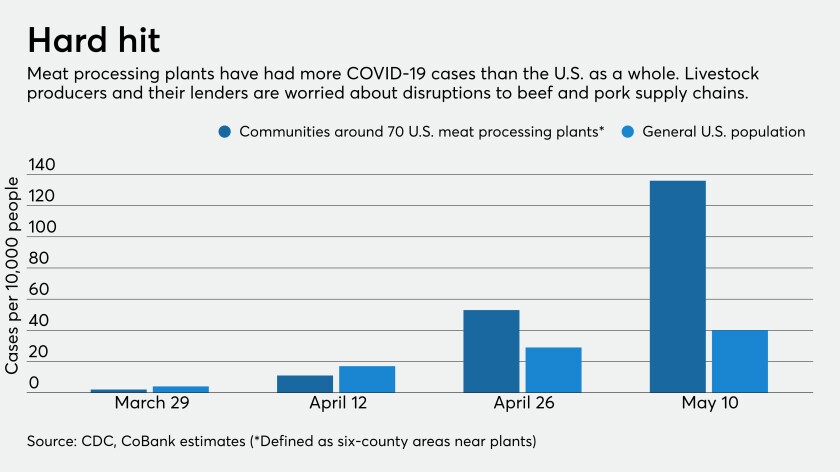

4 Min ReadLenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

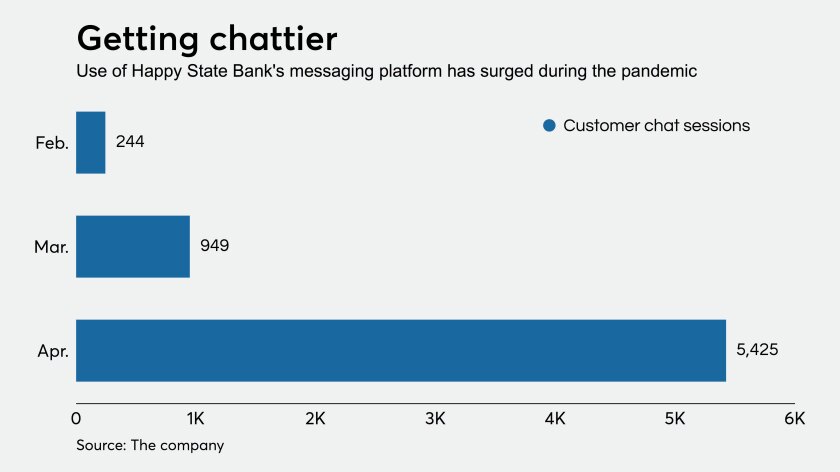

3 Min ReadThe Texas bank is leaning on solutions from Lightico and MANTL to quickly set up accounts and handle loans when customers can’t sign documents in person because of the coronavirus emergency.

8 Min ReadSaul Van Beurden's team is tasked with keeping systems running during the pandemic, including driving equipment to homebound workers. Yet the bank must continue making upgrades demanded by regulators, investing in new technology and recruiting top talent, he says.

4 Min ReadOperation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

4 Min ReadCritics of the Community Reinvestment Act revamp want to freeze the rulemaking process. That would only delay financial help to New York and other hard-hit cities.

5 Min ReadU.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

3 Min ReadThe Term Asset-Backed Securities Loan Facility is just one example of a fund that could be retooled.

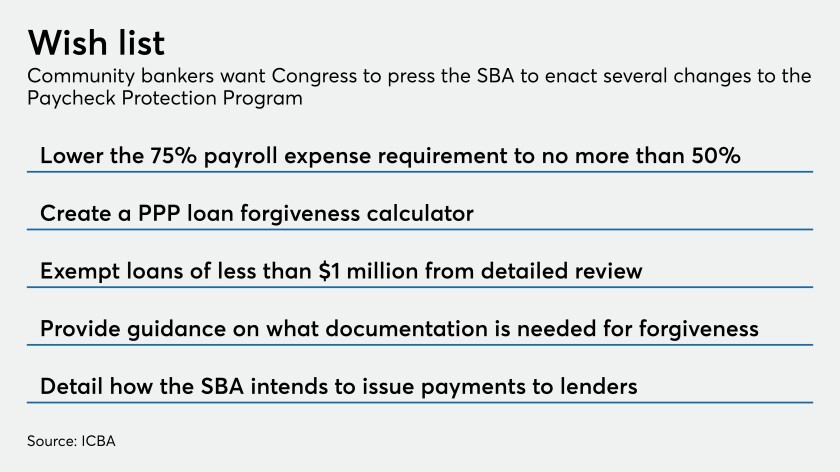

4 Min ReadBanks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

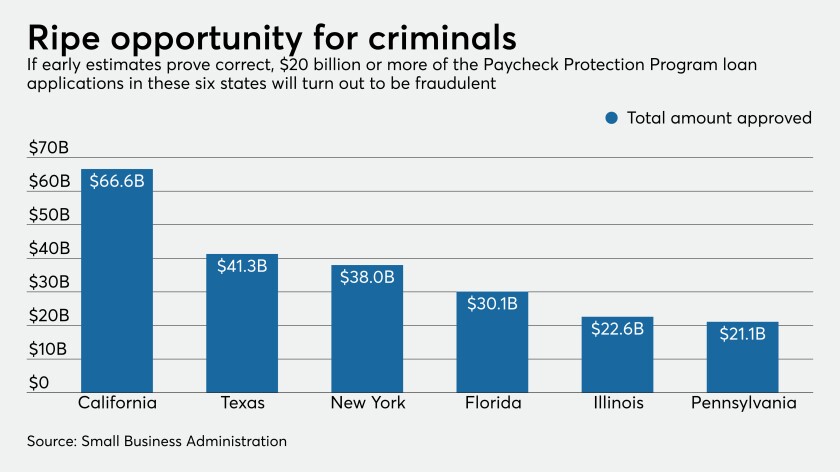

8 Min ReadUp to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

3 Min ReadThrough its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

3 Min ReadCoronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.

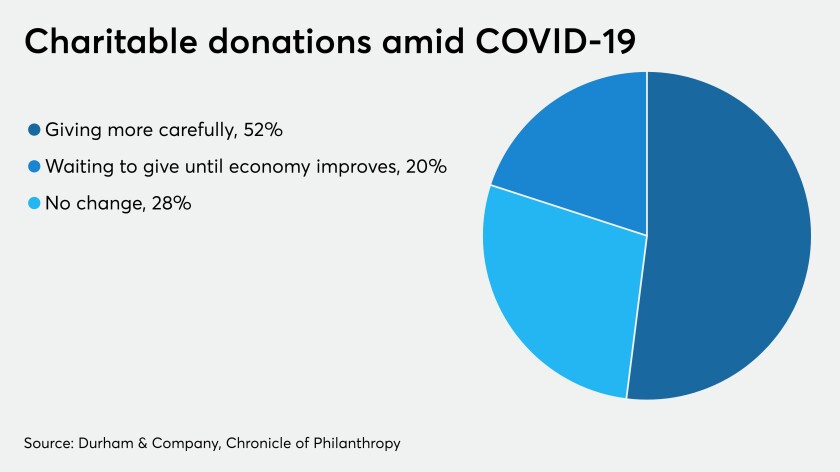

6 Min ReadIndustry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.