- 8 Min Read

Saul Van Beurden's team is tasked with keeping systems running during the pandemic, including driving equipment to homebound workers. Yet the bank must continue making upgrades demanded by regulators, investing in new technology and recruiting top talent, he says.

4 Min ReadOperation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

4 Min ReadCritics of the Community Reinvestment Act revamp want to freeze the rulemaking process. That would only delay financial help to New York and other hard-hit cities.

5 Min ReadU.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

3 Min ReadThe Term Asset-Backed Securities Loan Facility is just one example of a fund that could be retooled.

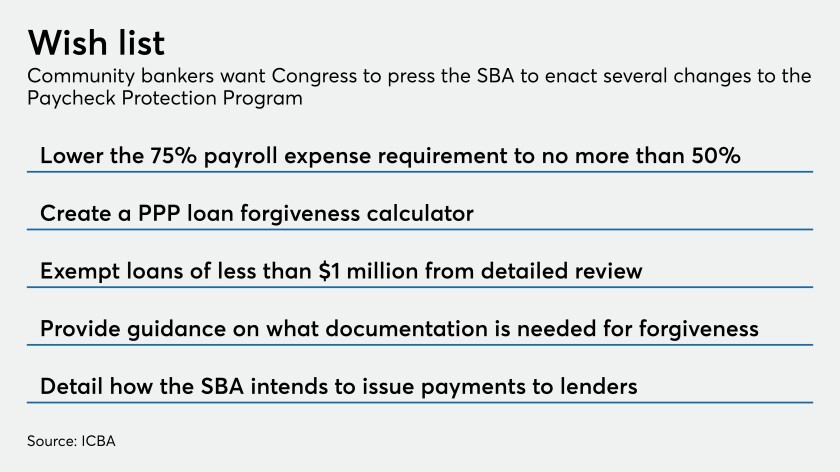

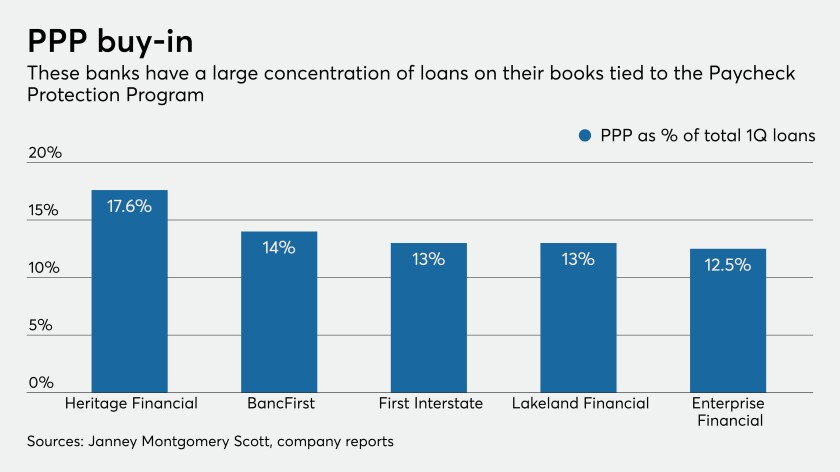

4 Min ReadBanks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

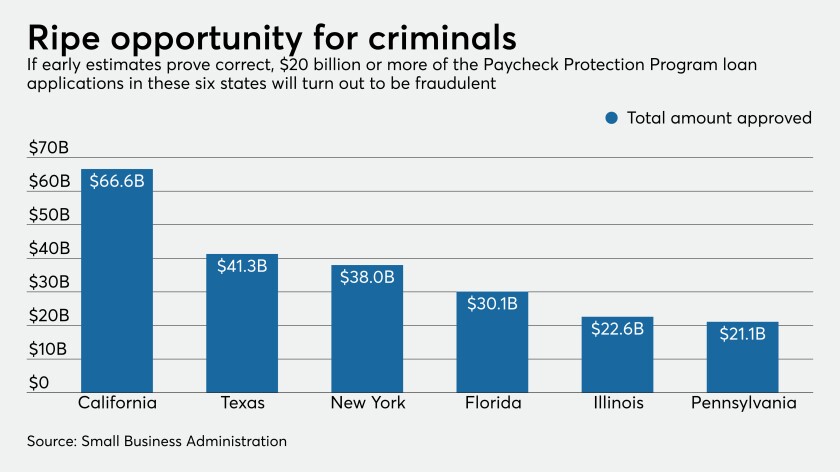

8 Min ReadUp to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

3 Min ReadThrough its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

3 Min ReadCoronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.

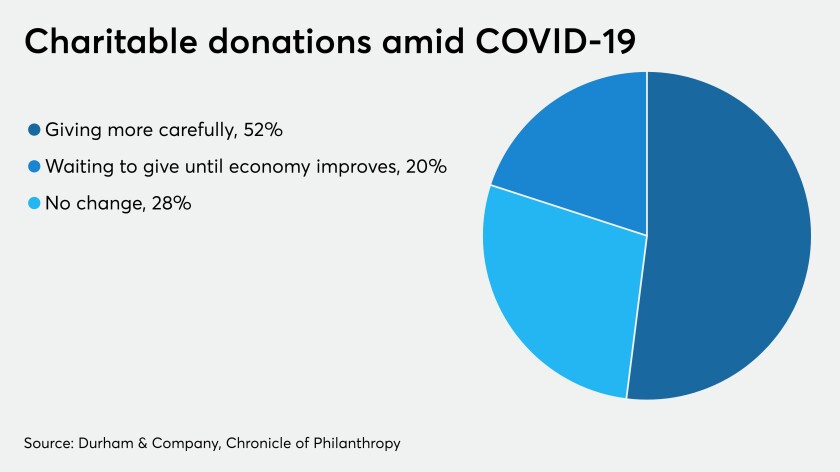

6 Min ReadIndustry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.

6 Min ReadBankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

5 Min ReadBanks tend to pull back in times of crisis by tightening credit and focusing on collections efforts. But consumers, and not returns, must be the focus during the coronavirus pandemic.

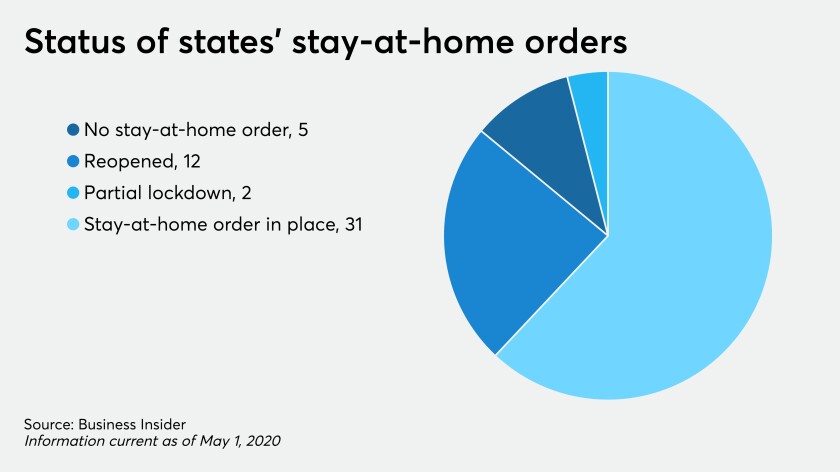

6 Min ReadCredit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

4 Min ReadRegulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

4 Min ReadIt's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

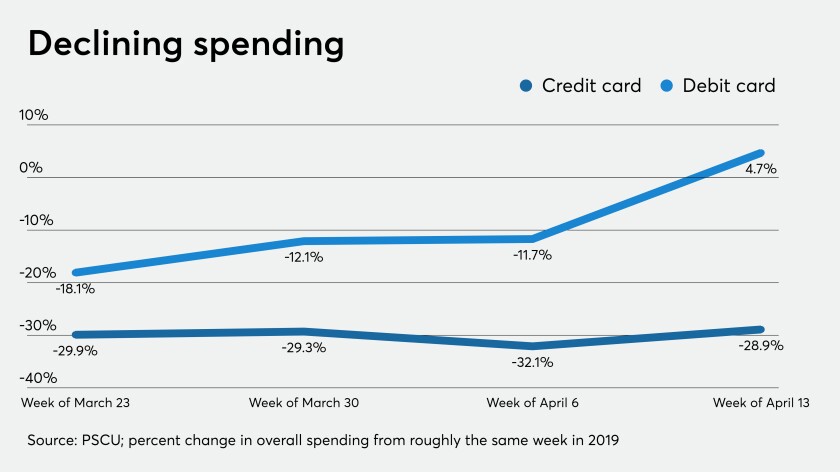

5 Min ReadConsumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

6 Min ReadFinancial institutions are finding that on-screen agents can offer most services that occur in a branch, but with a more personal touch than the phone or internet.

6 Min ReadUse of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

4 Min ReadLawmakers should approve a program to distribute stimulus funds using a government-sanctioned coin, which would be speedier than the current system.

5 Min ReadThe program, created in response to the 2008 financial crisis, generated $19 billion in small-business loans. It could be used as a viable path out of the coronavirus pandemic.