Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

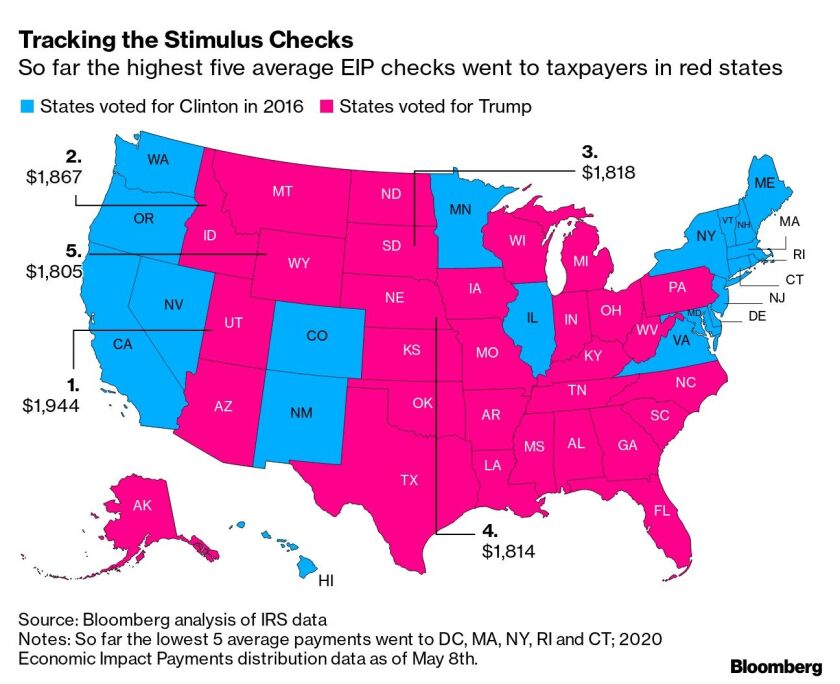

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.

The IRS is extending the claims period for health care flexible spending arrangements and dependent care assistance programs and enabling taxpayers to make mid-year changes to their accounts.

The Internal Revenue Service is giving taxpayers who want to receive their economic impact payments by direct deposit a tight deadline.

The decision, prompted by requests from a bipartisan group of lawmakers, reverses previous IRS guidance.

The Internal Revenue Service said individuals who got a $1,200 stimulus payment intended for someone who’s deceased or incarcerated should return the money but left open the question of how the agency would enforce that.

The Internal Revenue Service has posted information on how people who weren’t supposed to receive their economic impact payments for the novel coronavirus pandemic should return the money.

A bipartisan group of lawmakers introduced legislation Wednesday to enable small businesses to deduct their expenses even if they have received a loan from the federal government’s Paycheck Protection Protection Program that was later forgiven.

The Settlement Days program is trying out remote options in Detroit and Atlanta.

Leaders of Congress’s tax-writing committees want employers to be able to continue providing health insurance to their furloughed employees and still qualify for tax credits.