Small businesses that manage to get their Paycheck Protection Program loans forgiven may find themselves losing valuable tax breaks, according to new guidance from the Internal Revenue Service.

The Internal Revenue Service announced that it is delaying its Special Enrollment Examination tests for Enrolled Agents due to the ongoing novel coronavirus pandemic shutting down its testing centers.

The U.S. Treasury Department is planning to instruct people whose deceased relatives received coronavirus stimulus payments to return the money to the federal government, according to a department spokesman.

The Internal Revenue Service is urging some benefits recipients to register their children and other dependents for the extra $500 per child stimulus payments by May 5 if they haven’t already filed a tax return for 2018 or 2019.

The service says it won't be able to provide protective equipment immediately.

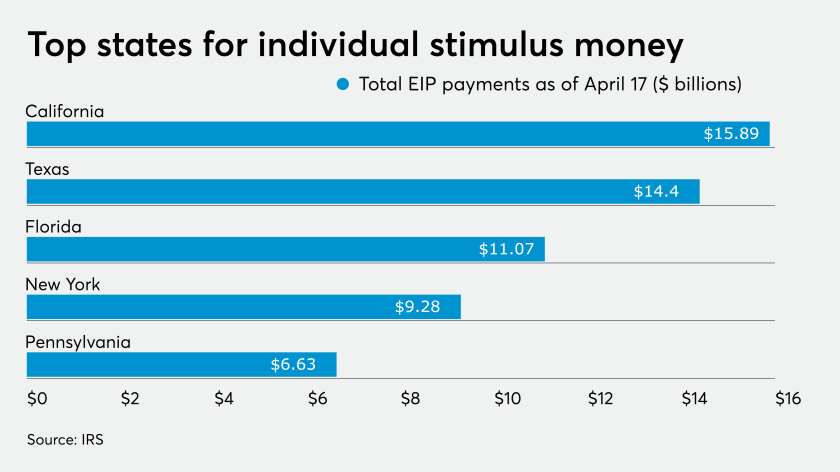

The IRS announced it has delivered 88 million Economic Impact Payments as of April 17, 2020.

Democrats on the tax-writing House Ways and Means Committee have sent a letter to Treasury Secretary Steven Mnuchin asking what has happened with the delayed economic impact payments.

The Internal Revenue Service and the Treasury Department provided cross-border tax guidance Tuesday to provide relief to individuals and businesses affected by travel disruptions arising from the novel coronavirus pandemic.

The American Institute of CPAs’ Auditing Standards Board has decided to defer the effective dates of seven of its recently issued Statements on Auditing Standards because of the novel coronavirus pandemic.

Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.