President-elect Joe Biden’s $1.9 trillion COVID-19 relief plan is designed to both pump money into the economy and contain the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion economic relief proposal serves as the opening salvo in a legislative battle that could be prolonged by the go-big price tag and the inclusion of initiatives opposed by many Republicans.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

Leaders of the Big Four CPA firms and major companies are stepping in and asking Congress to allow a smooth transition to the Biden administration.

Given the size and number of tax changes proposed by the Biden administration, it’s no wonder advisors face challenges in helping clients prepare for the year ahead.

Republicans will likely block Democrats’ attempts to have the Senate follow the House in boosting stimulus payments for most Americans to $2,000, even though President Donald Trump backs the bigger checks.

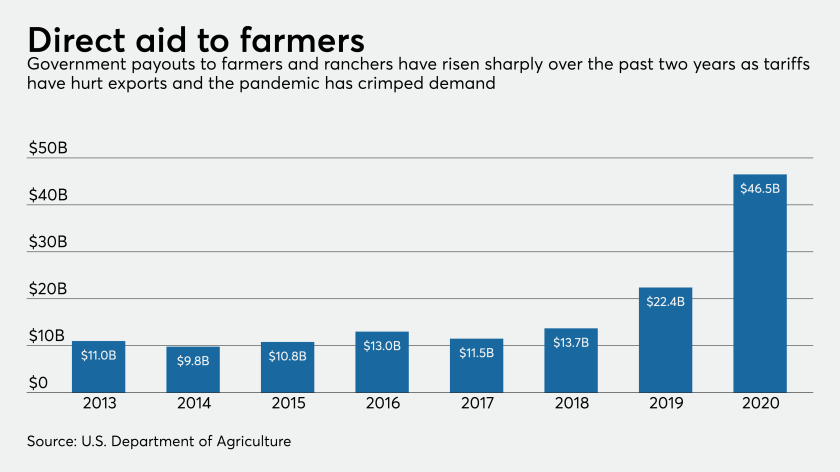

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

The outcomes of two elections in Georgia that are scheduled for Jan. 5 are expected to determine the balance of power in the Senate and may also have an impact on the kind of tax planning that accountants should be advising their clients to do.

Economic experts believe the current surge is not enough to stop continued losses incurred by various segments of economy.

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.