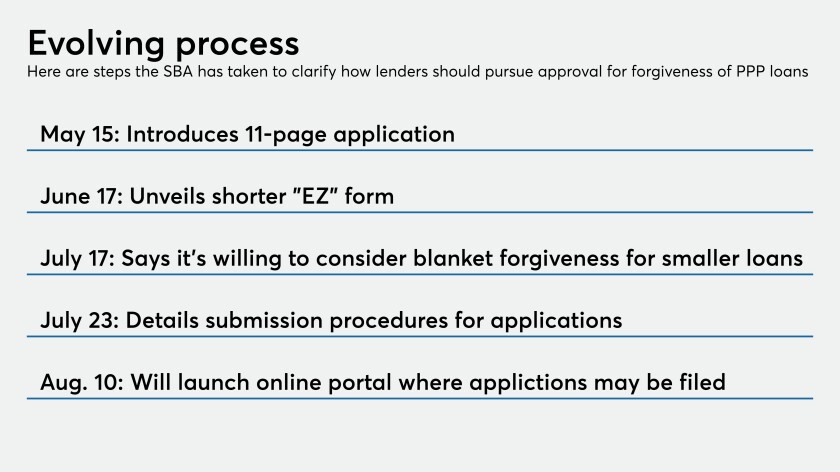

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

The owner of The Shuckery in Petaluma, Calif., says she was unable to get a Paycheck Protection Program loan until she responded to an email from the delivery service and BlueVine.

This personal funding has blurred the line between personal and business finances more than ever.

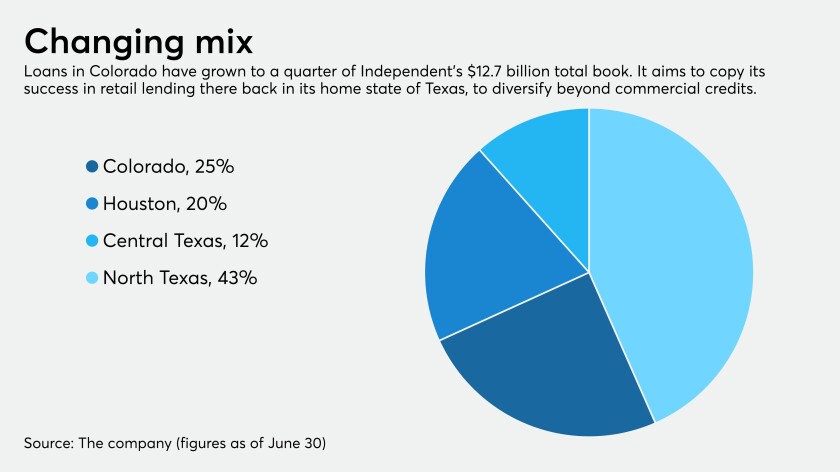

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

The pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.