Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

The global protests in the wake of George Floyd’s death should serve as a reminder that the banking industry must do more to support minority employees and customers.

The payroll provider has been partnering with accountants to help them secure loans for their small businesses.

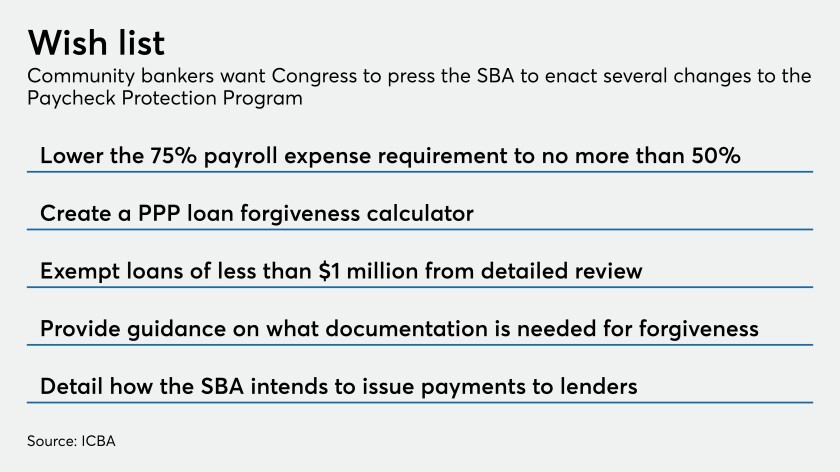

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.