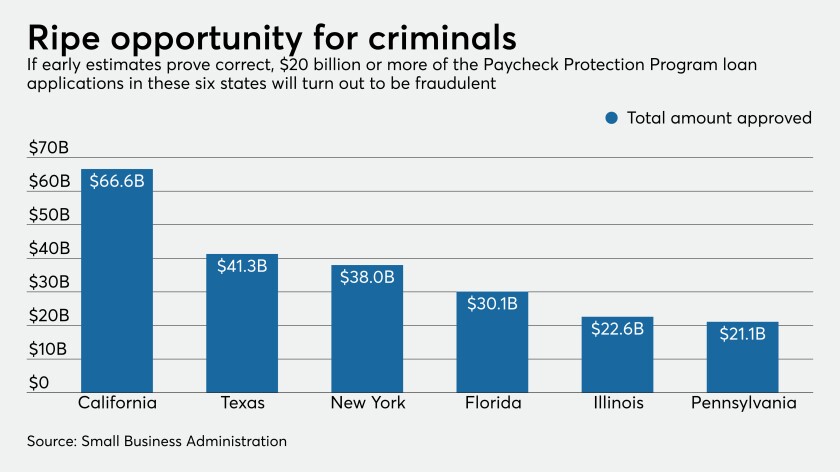

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

Regulators need to give more detailed guidance on the coronavirus relief program for small businesses so lenders don’t get trapped in underwriting mistakes down the road.

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

The Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

Fintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

Queued-up loans. Extra bankers. Government tweaks to promote fairness. None of these precautionary measures has been enough for the second round of the Paycheck Protection Program to avoid the pitfalls of the first.

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.