Digital banking has ramped up during the coronavirus lockdown but customers will seek somewhere to go as cities reopen. A branch could provide that safe haven.

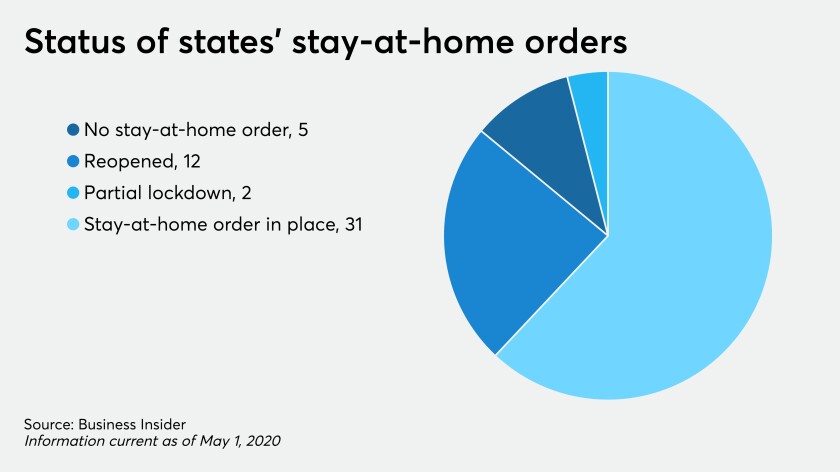

Credit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

Financial institutions are finding that on-screen agents can offer most services that occur in a branch, but with a more personal touch than the phone or internet.

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

The coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

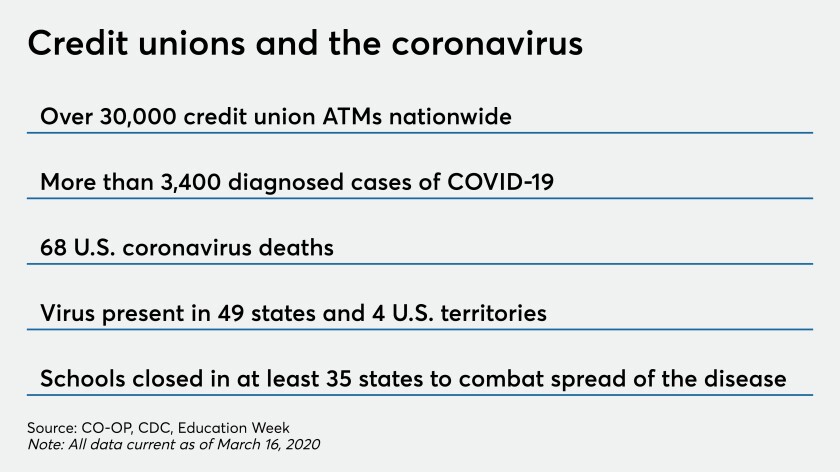

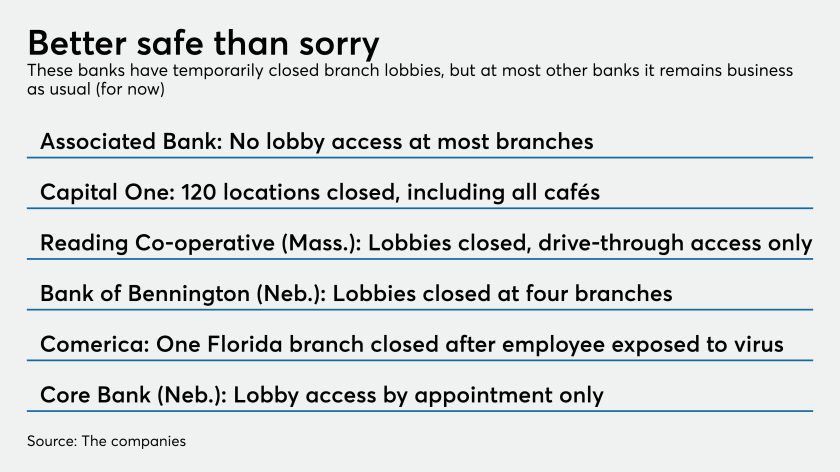

Institutions across the country are restricting entrance to their facilities to help curb the spread of COVID-19 but profitability issues could crop up if the pandemic drags on.

As more states close schools and issue shelter-in-place directives, credit unions are increasingly shifting their staff to work-from-home arrangements.

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.