For families who employ a nanny to care for their children in the home, there is the extra concern of what to do with their employee.

The application from the Treasury leaves many questions unanswered.

The Internal Revenue Service and the Treasury Department are beginning to send nearly 4 million economic impact payments by prepaid debit card, instead of by paper check or direct deposit.

Crowe has joined the growing number of firms offering solutions to aid in Paycheck Protection Program participation.

The Internal Revenue Service is bringing in more help to deal with the flood of calls about economic impact payments.

Members of the American Accounting Association's Financial Reporting Policy Committee denounce provisions in the CARES Act they see as threatening FASB’s independence and setting a dangerous precedent with serious potential to undermine confidence in corporate financial reporting.

The U.S. Small Business Administration, in conjunction with the Treasury Department, released a loan forgiveness application for the SBA’s troubled Paycheck Protection Program, along with detailed instructions for the application.

Tax practitioners share the questions they’re getting asked most, and how they’re answering.

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

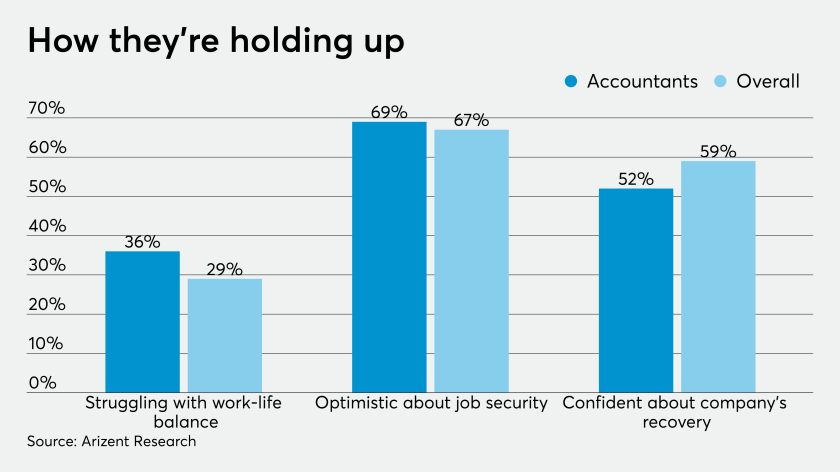

More than half expect to be back to a more normal work environment in less than six months, according to a new survey.