Lax eligibility requirements are raising new questions about which firms should get access to public money.

The Small Business Administration’s troubled Paycheck Protection Program appears to be providing more businesses with long-awaited loans, despite the rocky rollout and ever-changing guidance, according to a new survey.

The Internal Revenue Service guidance caused some consternation among some small businesses and tax experts.

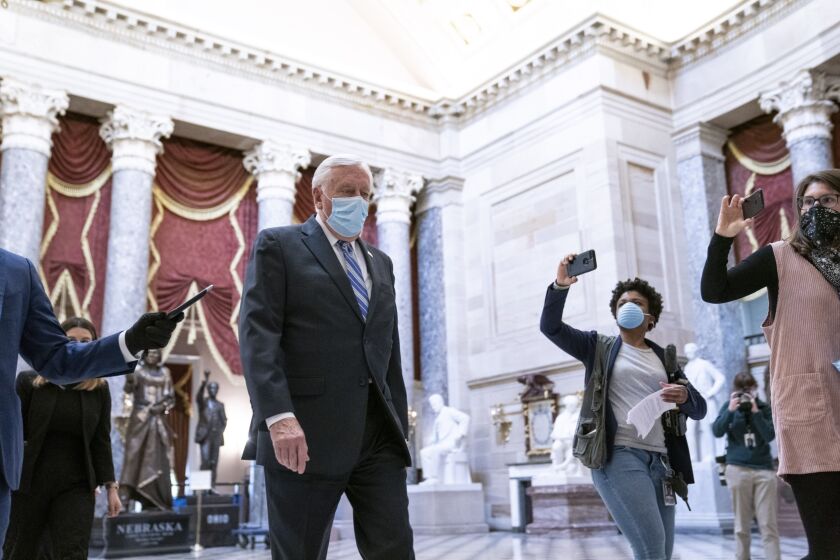

Republicans universally rejected a $3 trillion stimulus measure drafted by House Democrats to bolster the U.S. economy, but the draft plan has the seeds for an eventual, smaller compromise.

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

We have all spent so much time and energy applying for the Paycheck Protection Program, trying to interpret and decipher the intent behind the words.

The tax prep chain is offering consulting services starting at $99.

The decision, prompted by requests from a bipartisan group of lawmakers, reverses previous IRS guidance.

As special IG for the Treasury’s allocation of $500 billion in aid, Brian Miller could look into funding for Fed credit facilities. But Democrats on the Senate Banking Committee questioned his independence.

There's a great deal of help for businesses in the CARES Act and the FFCRA.