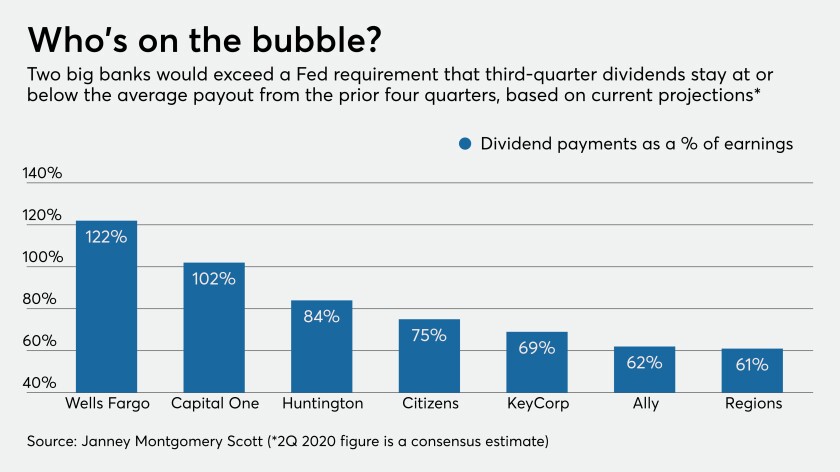

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

Now perhaps more than ever, banks and their proxies need to show tact when communicating with past-due borrowers.

The coronavirus’ economic fallout has drawn more attention to buy-now-pay-later options, leading to fresh creativity in business models and marketing.

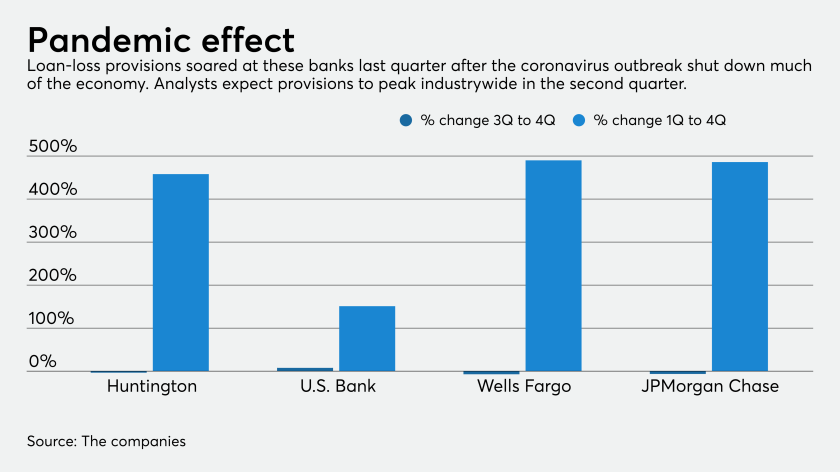

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

A bipartisan group of lawmakers has introduced legislation to close a loophole in the CARES Act.

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.