Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

The Term Asset-Backed Securities Loan Facility is just one example of a fund that could be retooled.

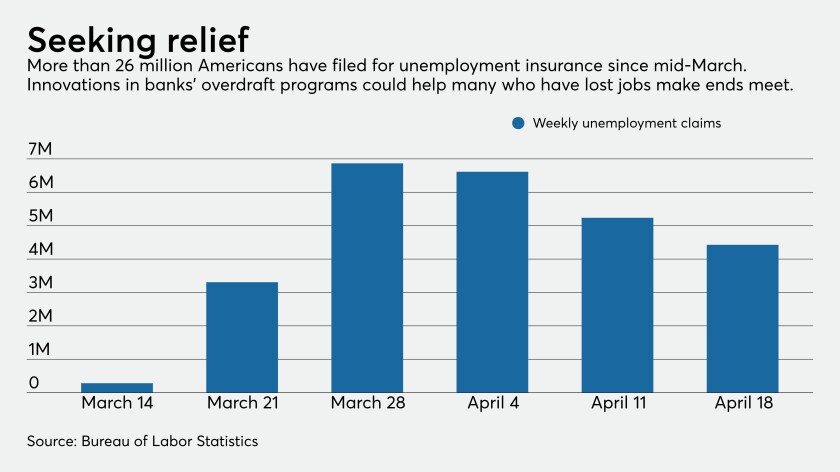

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

In a rare show of unity, banking industry and consumer advocacy groups told congressional leaders that it is not too late to ensure individuals can access all of their coronavirus relief funds promised by the government.

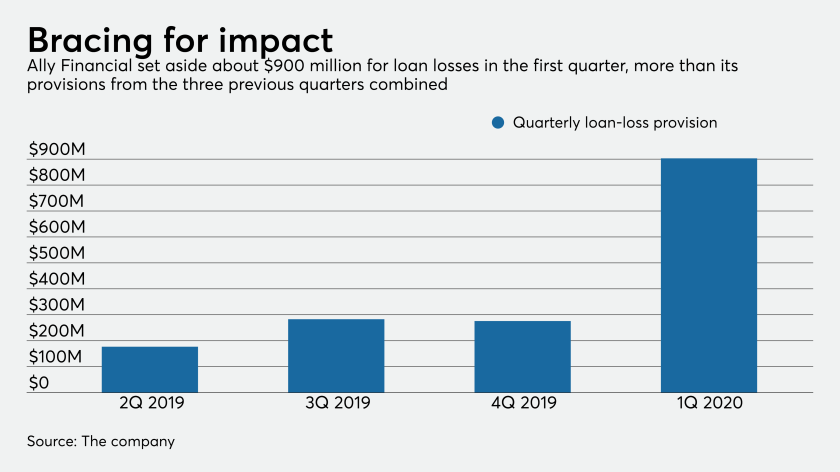

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.