Tax-refund delays and stimulus-payment hiccups could spill into the upcoming tax season as the Internal Revenue Service continues to face challenges related to the coronavirus pandemic and as Congress considers yet another round of direct payments.

With the filing season upon us, a raft of brand new challenges await ahead of the April 15 deadline.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

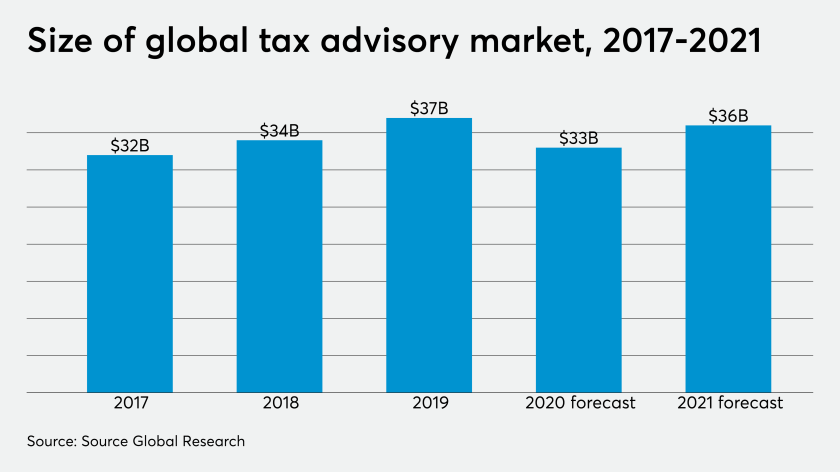

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

The U.S. Small Business Administration and the Treasury Department relaunched the Paycheck Protection Program on Monday to new borrowers, prioritizing loans from community lenders.

Growth in small business jobs and wages declined last month as a result of the novel coronavirus pandemic, according to payroll giant Paychex.

The economic fallout from the coronavirus pandemic is continuing.

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

The Internal Revenue Service and the Treasury Department released guidance on claiming deductions for expenses associated with Paycheck Protection Program loans that have been forgiven.