The Internal Revenue Service is once again depositing the latest round of Economic Impact Payments in the wrong bank accounts in a replay of problems experienced last year by many taxpayers.

Professional services like accounting and tax prep gained 12,000 jobs, however, according to the payroll giant.

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

The relief bill includes an extension of the 45Q tax credit, which gives companies a tax break for capturing carbon..

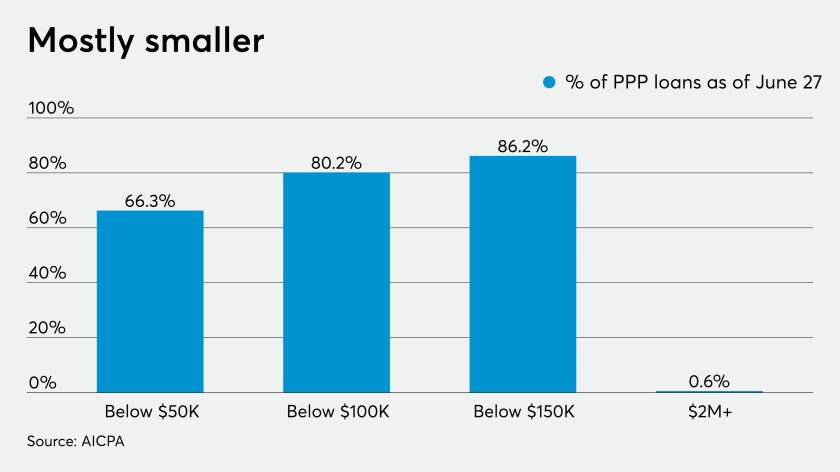

As the time comes for businesses to apply for PPP loan forgiveness, CPAs can provide vital assistance to ensure success for their clients.

Senate Majority Leader Mitch McConnell on Wednesday closed off chances that the Senate would pass anytime soon a House bill that would give most Americans $2,000 stimulus payments.

The initial direct deposits of the second round of economic impact payments are already going out to taxpayers.

Senate Majority Leader Mitch McConnell on Tuesday blocked an attempt by Democrats to force quick action increasing direct stimulus payments to $2,000 as President Donald Trump warned that failing to act now amounted to a “death wish” by Republicans.

With only a few days to go before the end of a difficult year, some accountants and tax professionals are still hoping to finish up some perplexing issues for their clients before New Year’s Day.

Republicans will likely block Democrats’ attempts to have the Senate follow the House in boosting stimulus payments for most Americans to $2,000, even though President Donald Trump backs the bigger checks.